Coinbase Launches cbETH, Its ETH Liquid Staking Token

Coinbase released cbETH, its Ethereum liquid staking token. Essentially, Coinbase is allowing investors to withdraw staked ETH before the Merge.

Coinbase released cbETH, its long-rumored Ethereum liquid staking token, on Wednesday. Each cbETH represents one ETH staked through Coinbase's Ethereum staking program, as well as the interest the staked ETH accrues.

The move will help Coinbase compete with staking giant Lido, which accounts for 30% of all staked ETH and over 90% of liquid staked ETH. Coinbase is a distant second, accounting for 15% of all staked ETH.

Crypto staking is important for Coinbase. According to Yueqi Yang, Coinbase earns 8.5% of its revenue from staking customer crypto, and the company made a major investment in institutional-grade ETH liquid staking startup Alluvial in May 2022.

What is cbETH and Liquid Staking?

Last year, large numbers of Ethereum holders locked their ETH into staking contracts to support Ethereum's transition to proof-of-stake, aka the Merge. Staked ETH won't be unlocked until at least six months after the Merge, but it accrues interest while it's locked up. Liquid staking programs, like market leader Lido, offer liquid tokens as "receipts" for staked ETH and the interest it accrues.

Each cbETH represents one ETH staked through Coinbase, plus the interest it accrued starting on June 12, 2022. Everyone with ETH staked through Coinbase should receive cbETH, distributed 1:1 for the staked ETH.

This is a huge deal–this means your ETH is no longer locked up indefinitely! Many retail investors staked their ETH when the market was more stable (and ETH was more valuable).

cbETH Market Response

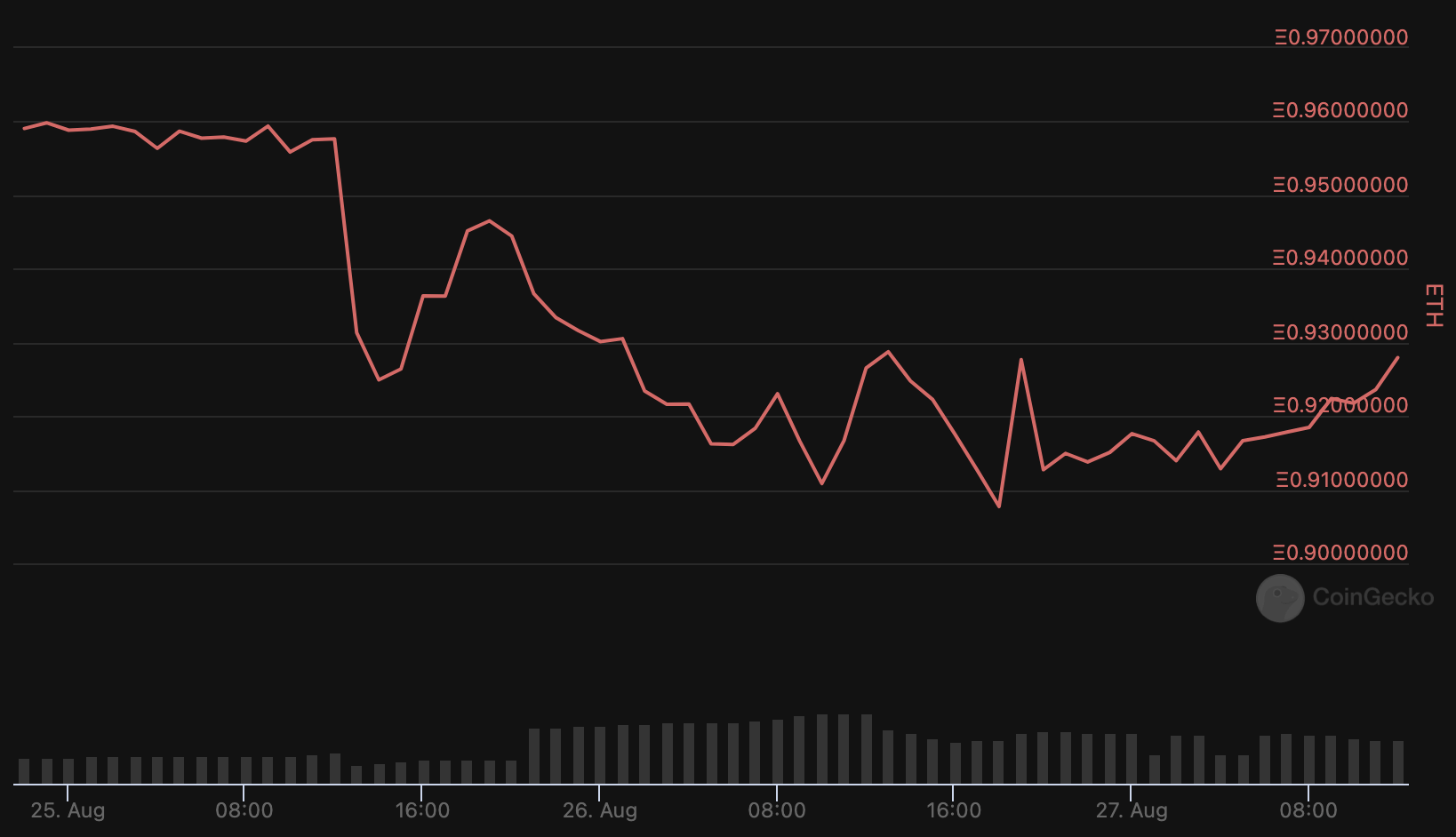

While one cbETH may represent one ETH, it isn't trading for one. Currently, a cbETH trades for about .92 ETH–an 8% discount on ETH, not counting the accrued staking interest. In contrast, a Lido Staked ETH, or STETH, trades at .97 ETH.

So why is cbETH worth so much less than STETH?

I'm guessing that most of the ETH staked on Coinbase was staked with the platform when ETH was worth more than it is today. So the retail investors who staked their ETH are way down on their investments today.

I'm also guessing, since Coinbase is the most popular retail platform in America, that lots of the people who staked ETH on Coinbase now need to sell that ETH to pay for living expenses. It's possible that STETH is worth more because a STETH can be redeemed for more interest, but the price difference seems too great between cbETH and STETH for that to be the only reason.