How the TIME Wonderland Rug Pull Crashed Terra LUNA

As Wonderland's TIME token crashes, leveraged yield farming positions on lending platform Abracadabra pairing MIM and UST are closing.

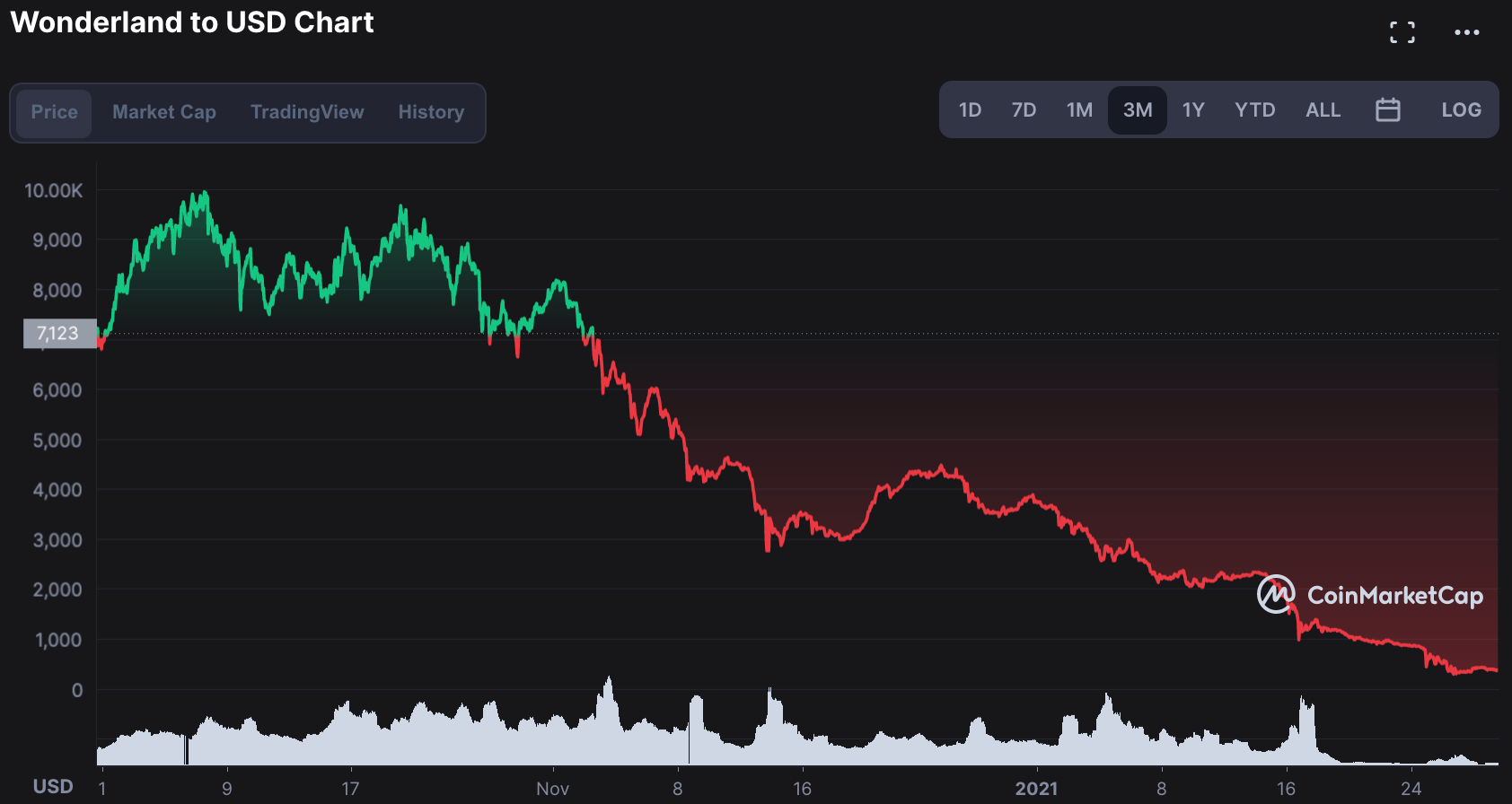

An alleged rug pull affecting Wonderland (TIME) is crashing the Terra ecosystem's LUNA token. Over the last three months, TIME has fallen to $365 from $10,000. Last week, TIME had two days where it lost more than 30% of its remaining value. LUNA has dropped to $48 from $70 over the last week.

Michael Patryn is best known for running a Canadian crypto exchange that disappeared with over $100M of investors' money in 2019. Last week, he was revealed to be the pseudo anonymous CFO of Wonderland and to be closely associated with the Abracadabra lending platform and the Magic Internet Money (MIM) stablecoin.

Patryn is accused of removing money from the Wonderland project for a couple months, causing some investors to deem this a rug pull. This caused a steady downward trend in TIME’s value. Last week’s news of Patryn’s involvement in Wonderland accelerated the project’s decline.

The TIME token was supposed to go down in value slowly as Wonderland minted TIME to distribute to investors. As investors lost confidence in Patryn's projects, they quickly unwound their leveraged positions in TIME and MIM. This, in turn, had a negative effect on the Terra ecosystem, because Abracadabra frequently offered yield farming pairs that included Terra's US Dollar-pegged token, UST.

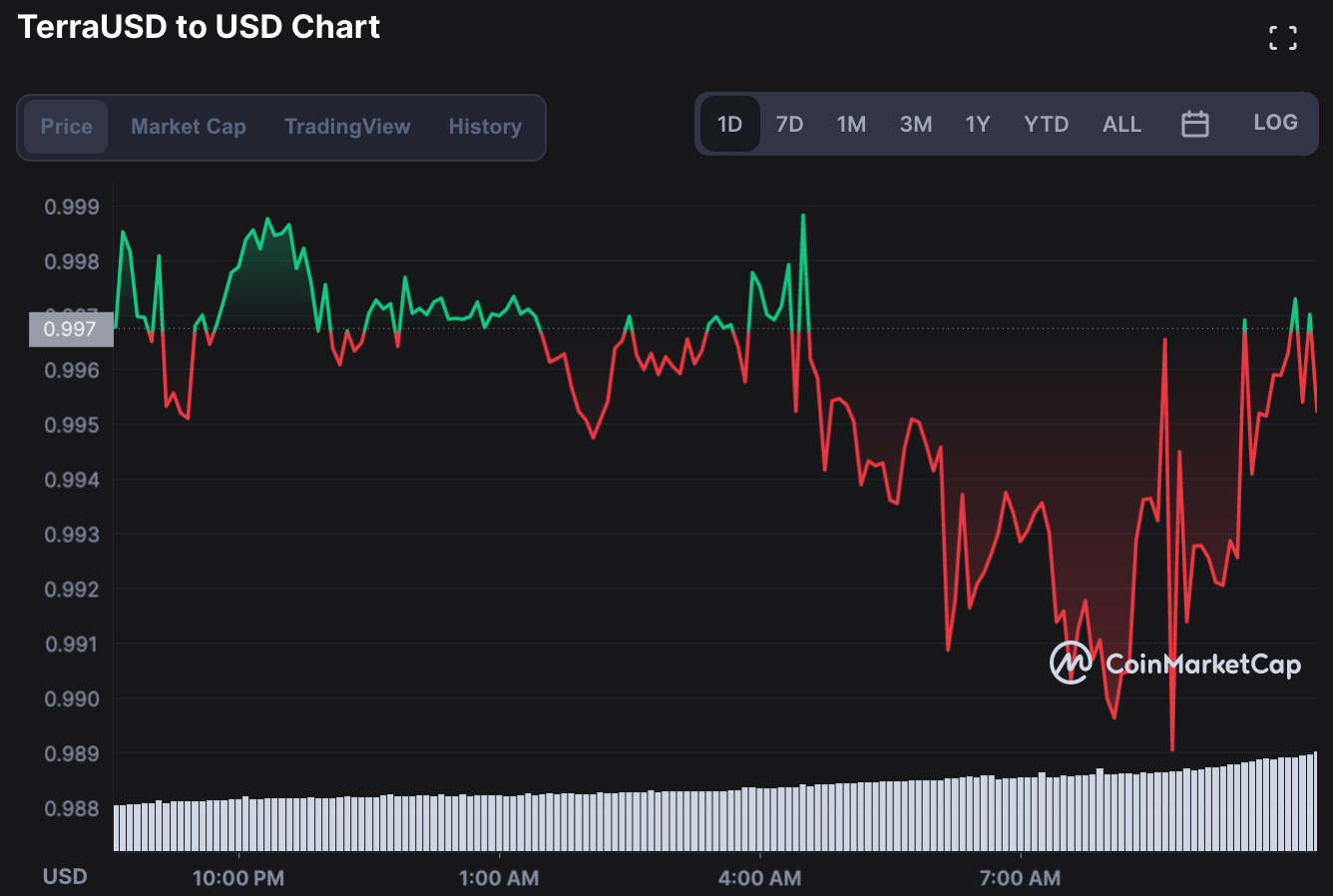

Terra is an algorithmic stablecoin ecosystem that mints stablecoins pegged to fiats, such as the UST token, pegged to the US Dollar. Terra uses the LUNA token for transaction fees within the network. As Terra mints more UST, it burns LUNA, which raises the price of LUNA and helps keep UST stable at $1.

As Reddit user M00OSE explains, "Abracadabra used UST to an unsustainable degree via the degenbox strategy, which allowed you to loop UST deposit to 10x leverage at most. This increased the amount of UST in the ecosystem and burned LUNA, propping up the price."

Investors were using "fake" MIM that was minted with leverage to create Terra's UST token, which subsequently burned LUNA, and which then increased the price of the LUNA token. As investors unwound their MIM positions to get out of TIME and Abracadabra, UST began to lose its peg to the US Dollar. When this discrepancy arises, Terra prints LUNA tokens in an effort to stabilize UST back at $1, but the LUNA token's price decreases as a result.

TL;DR: Investors took out leverage positions on Abracadabra to print MIM, and used that artificial MIM to purchase UST. Doing this increases the price of LUNA since creating UST burns LUNA. As the positions are closed, the artificial MIM disappears and more LUNA is created to keep the price of the UST stablecoin at $1.