Is Fantom the Last Undervalued L1?

This is a deep dive on Fantom's current market valuation, in particular how their TVL to market cap multiple stands to the market.

Do you remember back in August 2021 when there was a palpable buzz surrounding Solana? Like something unique was happening? It just felt special. Sometimes it just feels special. Right now, Fantom, the playful ghost-themed Layer-1 blockchain, feels special. Upon digging into a few metrics, Fantom is trading at half the multiple other major Layer-1’s are (more on that later).

Fantom is not the target of Reddit’s adoration; it doesn’t have a single charismatic oracle out there pumping it. What Fantom does have, however, is a coupling of interesting technology with strong stats and meaningful adoption. So let’s talk about what makes Fantom special.

The Trilemma

Fantom is a Layer-1 blockchain that features technical advancements that supersede those of older blockchains. To really appreciate its technical prowess, we need to talk about the “blockchain trilemma.” In short, the trilemma is derived from the inherent difficulty in building a blockchain that is scalable, secure, and decentralized. Projects usually focus on achieving two of these three pillars, and most major chains are struggling to get the third into place. Ethereum is secure and decentralized, but its gas fees preclude it from being very scalable. Solana is secure and extremely scalable, but it is not yet adequately decentralized (they keep getting taken down by DDOS attacks).

Then there’s Fantom. Fantom claims to have solved the blockchain trilemma via their consensus mechanism. A consensus mechanism is the thing that makes blockchains work. In a decentralized system, this is what lets all the individual nodes of the blockchain come together—what lets them reach a consensus on what the state is. In practice, this can look like simple “majority rules” voting, taking turns being the “leader” for a block, or any number of other mechanisms that exist.

Fantom uses an asynchronous Byzantine Fault Tolerant (aBFT) Proof-of-Stake consensus mechanism called Lachesis. There are a lot of technical details involved in aBFT consensus mechanisms (which you can read about on Fantom’s site), but the TL;DR is that less data is passed back and forth between nodes and they come to a consensus faster.

It should be noted that the Fantom network has not hit decentralization yet (at the time of writing this, there are only 55 nodes online). While this is important in the long run, projects like Solana seem to indicate that decentralization won’t be a blocker for price appreciation or early adoption. In fact, it may be a benefit for early projects to keep decentralization as the last leg of the trilemma to tackle. For projects like Fantom, decentralization looks like simply bringing on more validators to the network. The team has mentioned a goal of bringing on 1,000 additional validators in the next few years, but for now they haven’t solved the blockchain trilemma in practice.

Speed

Fantom also has the fastest time-to-finality (TTF) at roughly one second. Time-to-finality is the measure of time between sending a transaction and it being “complete” (impossible to be reverted). This is essentially a measurement of a blockchain’s latency, and in some cases, it is the critical measurement for a project’s viability on a blockchain. Bitcoin’s TTF is 60 minutes, for reference. TTF is incredibly important for any projects that involve financial transactions – imagine waiting an hour for your credit card to be approved at Starbucks.

Often a blockchain’s speed is measured in transactions per second (TPS). While this is an important measurement for volume of throughput on a blockchain, one might argue that this is a poor way to measure how fast a blockchain is. Newer blockchains often never hit their peak TPS, so it’s more of a vanity metric for how much the network can handle. In reality, the TPS doesn’t have any impact on the duration of a transaction unless the blockchain hits its peak TPS, in which case the transaction may be bumped to the next transaction window. TTF is frequently ignored in the discussion of speed, largely because the story of the past few years has been about Ethereum hitting peak TPS and struggling in response. In practice, the new generation of blockchains, which often support transactions far in excess of what they see, TTF is the best proxy network speed.

Pulling It All Together

Momentum obviously matters in the realm of cryptocurrency, and just about every crypto that has taken off recently has supported Ethereum (with Solana being the notable exception). Here, Fantom is no different. The project was built to be Ethereum Virtual Machine (EVM) compatible, meaning things built for Ethereum can easily be plugged into Fantom. Fantom also received $35M from Alameda Research, an investment company from the founder of FTX, Sam Bankman-Fried. This investment comes with the announcement that Alameda Research will be running a Fantom node and “Alameda Research [will enter] the Fantom ecosystem, collaborating with the Fantom Core team integrating Solana, Serum, Raydium, and other cross-chain products.”

This means Fantom could be the first major L1 to be universally cross chain. Most other L1s ignore non-EVM compatible blockchains like Solana because they make integration difficult. Integration with projects built on Solana, like Serum, would mean that Fantom could pull directly from the hard work done on building highly scalable automated market makers, which has facilitated the rapid growth of the Solana ecosystem.

Fantom has also attracted some of the highest quality talent in decentralized finance and blockchain development. Andre Cronje, the founder of one of the largest and earliest DeFi projects, Yearn Finance, is a main developer on Fantom. He’s considered one of the architects of the DeFi industry.

Let’s take a look at the landscape of major L1 performance:

| Fantom | Solana | Ethereum | Avalanche | |

|---|---|---|---|---|

| Transaction Cost (avg) | $0.20-$0.50 | $0.001 | $30-$300 | $1.15 |

| Time-to-Finality | ~1 sec | 13 sec | 1 min | 3 sec |

| Validators | 55 | 1,000 | 282,992 | 1,221 |

| Transactions per second | 25,000 | 50,000 | 14 | 4,500 |

Market Research

Blockchains by Daily Transaction Volume

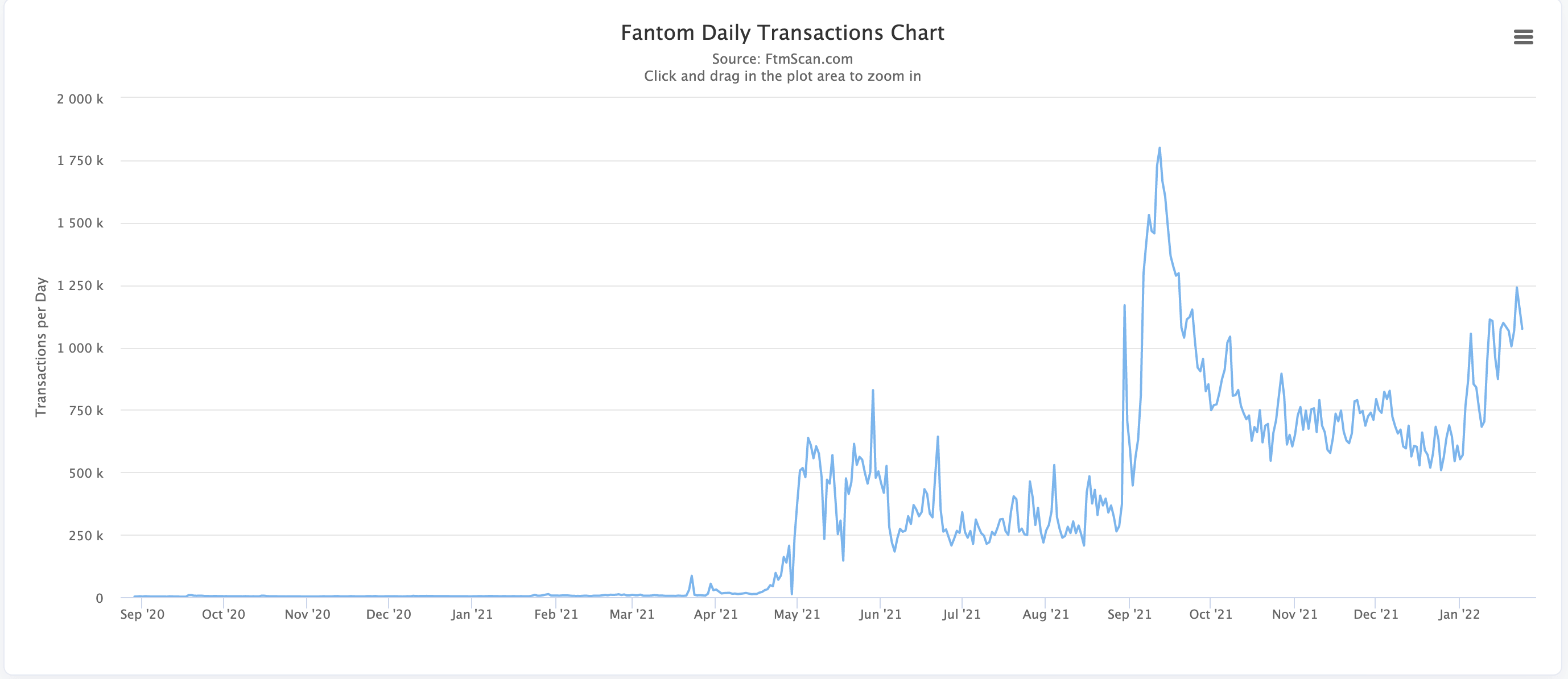

Daily transaction volume is a good proxy for how much real-world use a blockchain is getting. However, this number starts to get a little messy as the cost per transaction gets too low. Fantom saw daily transaction volume go from 4,000 to 750,000 in 2021, and has continued to see growth since.

| Ethereum | Fantom | Avalanche | |

|---|---|---|---|

| Daily volume | ~1,200,000 | ~1,000,000 | ~650,000 |

DeFi Total Value Locked

People are increasingly viewing total value locked (TVL) in a blockchains DeFi ecosystem as a measure of how much strength a blockchain’s adoption has. Two Fantom dApps recently hit a high water mark of $1.5B each in TVL: SpookySwap and Tomb Finance. Like all ecosystems, there are some growing pains in the form of DeFi contract hacks.

| Ethereum | Fantom | Avalanche | |

|---|---|---|---|

| Defi TVL | $112.3B | $12.5B | $8.09B |

Unique Addresses

Unique addresses are just how many addresses exist on a blockchain. This isn’t a measure of users, since one user can have many addresses. It’s still useful to see how many unique transactions are being made.

| Ethereum | Fantom | Avalanche | |

|---|---|---|---|

| Unique Addresses | 183M | 1.5M | 1.5M |

Active Addresses

This is a count of how many unique addresses are regularly performing transactions. This is a much better proxy for how many active users exist in the ecosystem.

| Ethereum | Fantom | Avalanche | |

|---|---|---|---|

| Active Addresses | 566,000 | 341,000 | 798,000 |

Comparing Multiples

| Ethereum | Fantom | Avalanche | |

|---|---|---|---|

| Market Cap | $267.2B | $5.2B | $14.1B |

| TVL | $112.3B | $12.5B | $8.09B |

| Multiple | 2.37x | 0.41x | 1.74x |

This puts Fantom at 4x under the Market Cap-to-TVL multiple that Avalanche has, and 5.5x under Ethereum’s multiple. The table below shows what Fantom’s price would be if it had the competitors’ multiples.

| FTM (0.41x) | ETH (2.37x) | AVAX (1.74x) | |

|---|---|---|---|

| FTM Price w/ Multiple | $2.05 | $11.85 | $8.70 |

During this market crash, while every blockchain has seen it’s price and TVL crash, Fantom has been picking up extra TVL. Over the past week, Fantom’s TVL is up 50% while every other coin in the top 10 is down double digit percentages.