Is the KuCoin Insolvency FUD Justified?

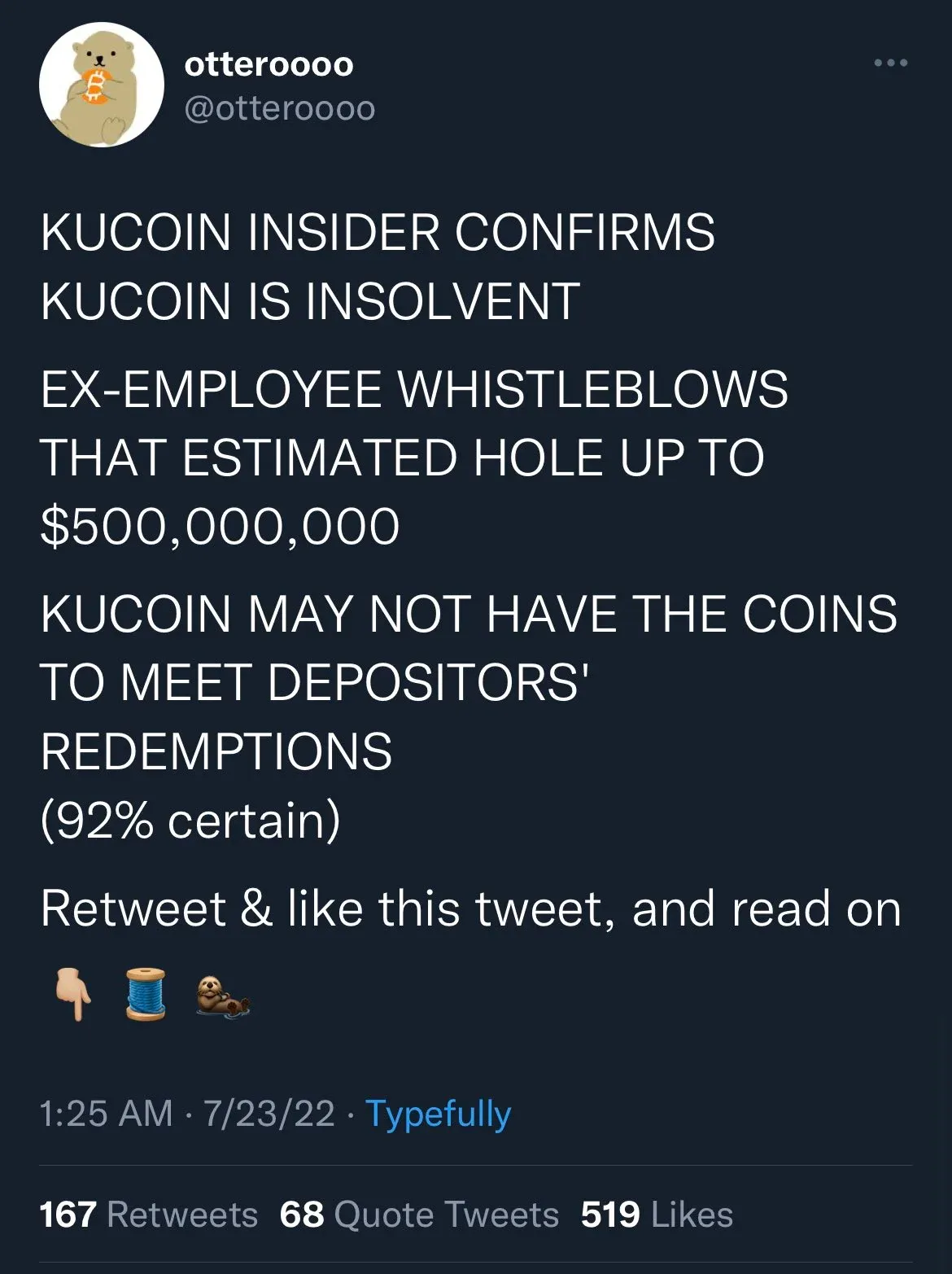

Twitter FUDster @otteroooo accused KuCoin of being insolvent then deleted his or her account.

Over the weekend, Twitter user @otteroooo, who has since deleted his or her account, accused KuCoin of being insolvent. This would be a major blow to the crypto economy, as KuCoin is the fifth largest centralized exchange (CEX) in the world, measured by trading volume. KuCoin CEO Johnny Lyu adamantly denies @otteroooo's claims, and KuCoin has not paused withdrawals.

@otteroooo was a popular Crypto Twitter account following the Terra collapse, which @otteroooo predicted. @otteroooo also called the downfall of several CeFi platforms well before they shut down, even as those platforms lied to the public about their solvency. So when @otteroooo claimed KuCoin was insolvent, people paid attention.

According to @otteroooo, a KuCoin employee claimed the exchange has a $500M hole in its balance sheet following the Terra collapse. This alleged employee says that KuCoin was the largest holder of wLUNA tokens, with 25% of the total supply. When LUNA went to zero, so too did wLUNA. Lyu denies KuCoin had any major exposure to LUNA or wLUNA. KuCoin claims @otteroooo and similar FUD accounts are coordinating bank runs.

Honestly, this is all getting tiring. KuCoin isn't the classiest exchange–it's the largest CEX that carries oddball cryptos, and it charges outrageous withdrawal fees. But that doesn't mean it's insolvent! KuCoin's lending program is very small compared to the total size of its business, so it's not likely that KuCoin got mixed up in the 3AC contagion.

As CeFi lending platforms continue to die off in the wake of the 3AC collapse, it wouldn't be surprising to see a CEX go down too. But that doesn't mean it'll be KuCoin. Either way, it's probably best to keep assets off of the exchanges for a while.