Jump Crypto and a16z at War Over Uniswap’s New Bridge

Jump Crypto and a16z are at war over Uniswap's bridge launch to Binance Smart Chain (BNB).

Ethereum’s largest DEX, Uniswap, is coming to Binance’s BNB Chain, but it’s not as simple as a yes or no vote. The community seems to be voting in favor of expanding Uniswap over to BNB Chain via a bridge, and I think that’s a great idea. PancakeSwap is the dominant DEX on BNB Chain and has a whopping $2.6B TVL. That’s more than Uniswap V3 has on Ethereum.

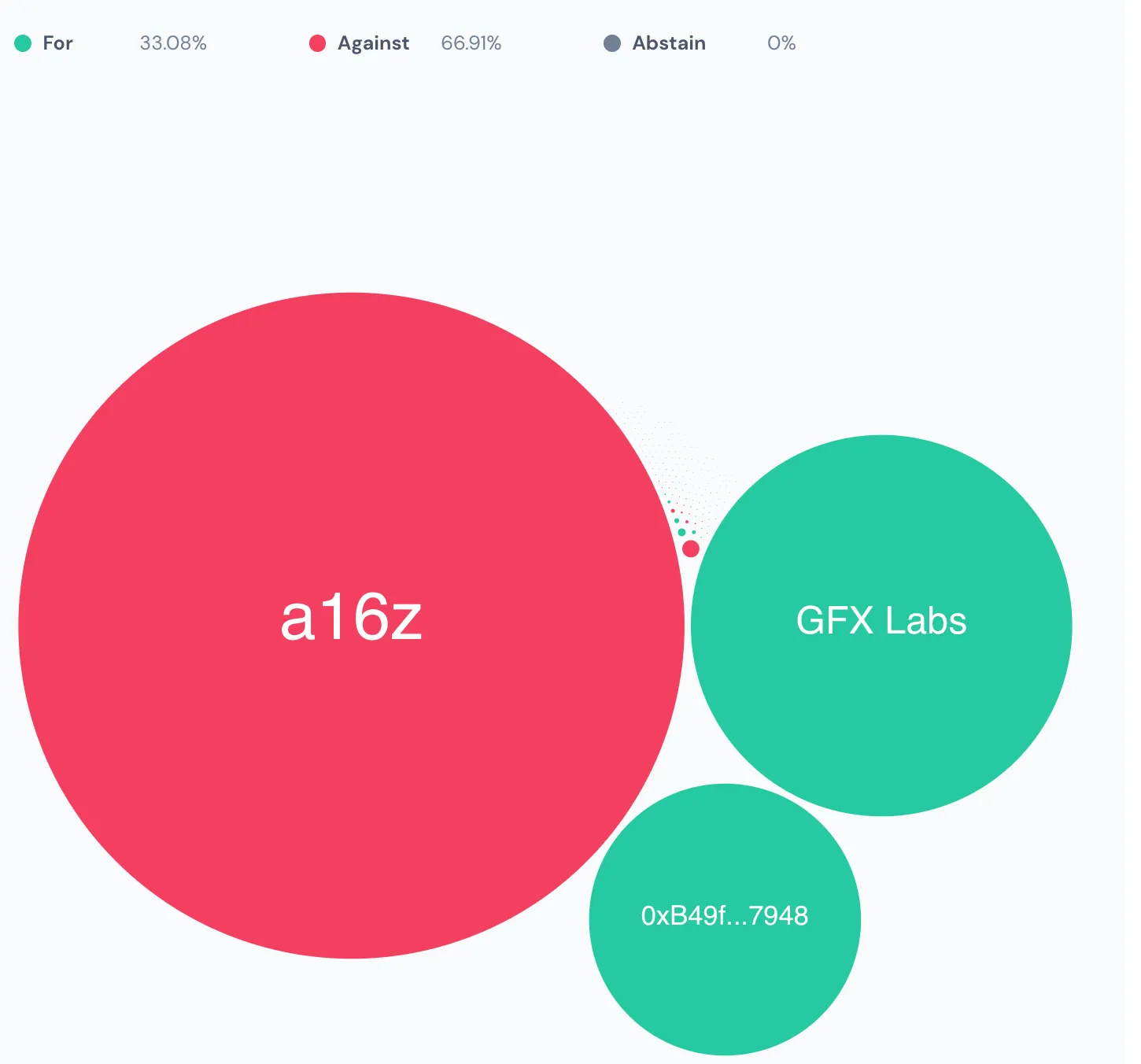

After an initial “temperature check” vote by the Uniswap DAO to see if they should expand to the BNB Chain, Uniswap put out a proposal to bridge to the BNB Chain. That vote looks like it’s going to fail, primarily because of the bridge details. Here’s where the drama comes in.

Uniswap has two major venture capital investors holding their tokens: Jump Crypto and a16z. A16z is an investor in the LayerZero bridge. Jump Crypto is an investor in the Wormhole bridge, the bridge that was attacked for $325M last year. The proposal put forward is to use Wormhole as the bridge to launch Uniswap V3 on BNB Chain with, something that a16z obviously would not want.

So how did we get here? Well, the previous vote included what bridge to use, and a16z was unable to vote in that due to their custodial structure. They’ve since changed that structure and will be able to fully participate in further votes, but in the meantime Jump slipped that vote through with Wormhole winning as the bridge.

Now A16z is putting their full weight against Uniswap moving forward with Wormhole. How much weight is that though? A16z has 15M UNI tokens to vote with, and currently 67% of the votes are against the proposal. Most proposals on Uniswap seem to conclude with 50-something million votes placed, and there have been 22.4M so far. Voting concludes this Friday, so right now it’s hard to say what will happen.

This all comes shortly after a CEO of another bridge, Nomad, accused the LayerZero team of running a backdoor into the bridge’s funds.

Here’s a breakdown of Uniswap V3’s TVL across all its chains as of December 2022. Note that PancakeSwap has more on BNB than Uniswap V3 has overall–this is a really big opportunity for Uniswap.

Total Value Locked - $2.6B

- Ethereum - $2.37B

- Polygon - $99.84M

- Arbitrum - $84.9M

- Optimism - $44.53M

- Celo - $865.4K