USDC Depegs as Silicon Valley Bank Contagion Spreads

Stablecoin USDC de-pegged after Circle admitted at least $3.3B of USDC's reserves are stuck in the insolvent Silicon Valley Bank.

Silicon Valley Bank is bringing the tech collapse to crypto. According to Circle, the company behind stablecoin USDC, at least $3.3B of USDC's reserves are now stuck in the insolvent bank.

On Friday, Silicon Valley Bank (SBV) went into FDIC receivership, triggering a $42B bank run on SVB's limited funds. Unfortunately for the crypto economy, Circle wasn't fast enough, and now they're reporting that $3.3B is stuck with SBV until the whole process gets sorted out.

Overall, USDC is supposed to have roughly $40B in reserves, so while having $3.3B locked up for a long time is bad, it shouldn't be the end of the world. But it may be: like most stablecoin issuers, Circle diversifies USDC's treasuries. Circle says it keeps about 25% of its total reserves as cash in banks, which would be ~$10B in cash. So USDC just lost 33% of its liquid cash reserves. That's alarming.

The initial scare that started the bank run on SBV came from a rapid loss of value in the bank’s bond holdings in response to rising interest rates. SBV needed cash due to a decline in customer deposits, so they were forced to sell these bonds at a loss before they matured. With USDC’s cash reserves declining, there’s a chance Circle could find itself in a similar situation, also dumping long-term holdings at a loss.

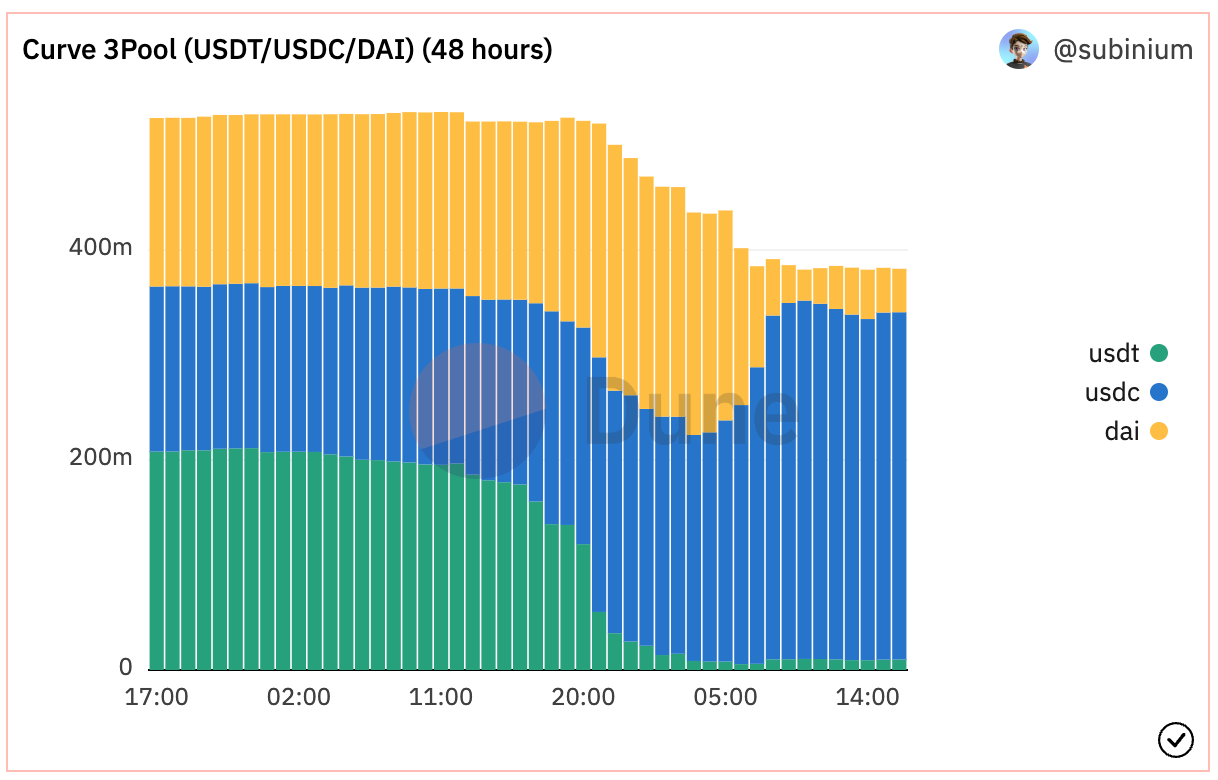

The USDC token is supposed to be worth exactly $1, but right now it's trading around $.91, with massive variations on lower liquidity markets. USDC is the second-largest stablecoin by market cap, and it's deeply integrated into the DeFi economy through Curve's 3pool.

Since news broke of Circle's SVB exposure, traders dumped their USDC for Tether, nearly emptying Curve's 3pool of USDT, which has the deepest liquidity available USDC-to-USDT swaps. MakerDAO's DAI stablecoin–which has ~$3B in USDC in its treasury–is also taking a beating. DAI is supposed to be worth $1, but it's currently trading around $.92 across most markets.

Whether this is a blip or the start of a major crypto crash remains to be seen. The crypto markets have been pretty rough following Silvergate's issues, SEC interventions, and a rough macro.