BAYC Fueled Bank Run Nearly Breaks BendDAO

A large amount of the collateralized loans on BendDAO backed by Bored Ape Yacht Club (BAYC) NFTs risked liquidation and caused a bank run.

There have been a number of interesting NFT projects built recently to make the tokens more flexible. The two things that have gotten a lot of buzz are fractional ownership of NFTs, letting you buy or sell portions, like 1%, of a Bored Ape, and loans collateralized by NFTs. By this point, the term “collateralized loan” probably makes you sweat.

BendDAO

BendDAO is a DeFi protocol allowing users to take out ETH loans collateralized by their NFTs. The protocol lets you borrow roughly 30-40% of the floor price of your NFT’s collection in ETH, which comes from people depositing ETH to get a return from their investments. It’s typical lending behavior that you would see in a bank: depositor gives bank cash, bank makes a loan for some interest, the depositor gets a cut of that interest.

If the price of an NFT, or ETH, changes too much, the person who received the loan may have their collateral liquidated. This mechanism works very well in typical DeFi markets that have very deep liquidity to liquidate collateral, but this isn’t a typical DeFi market. This is one of the most notoriously illiquid markets: art.

Monkey Bank Runs

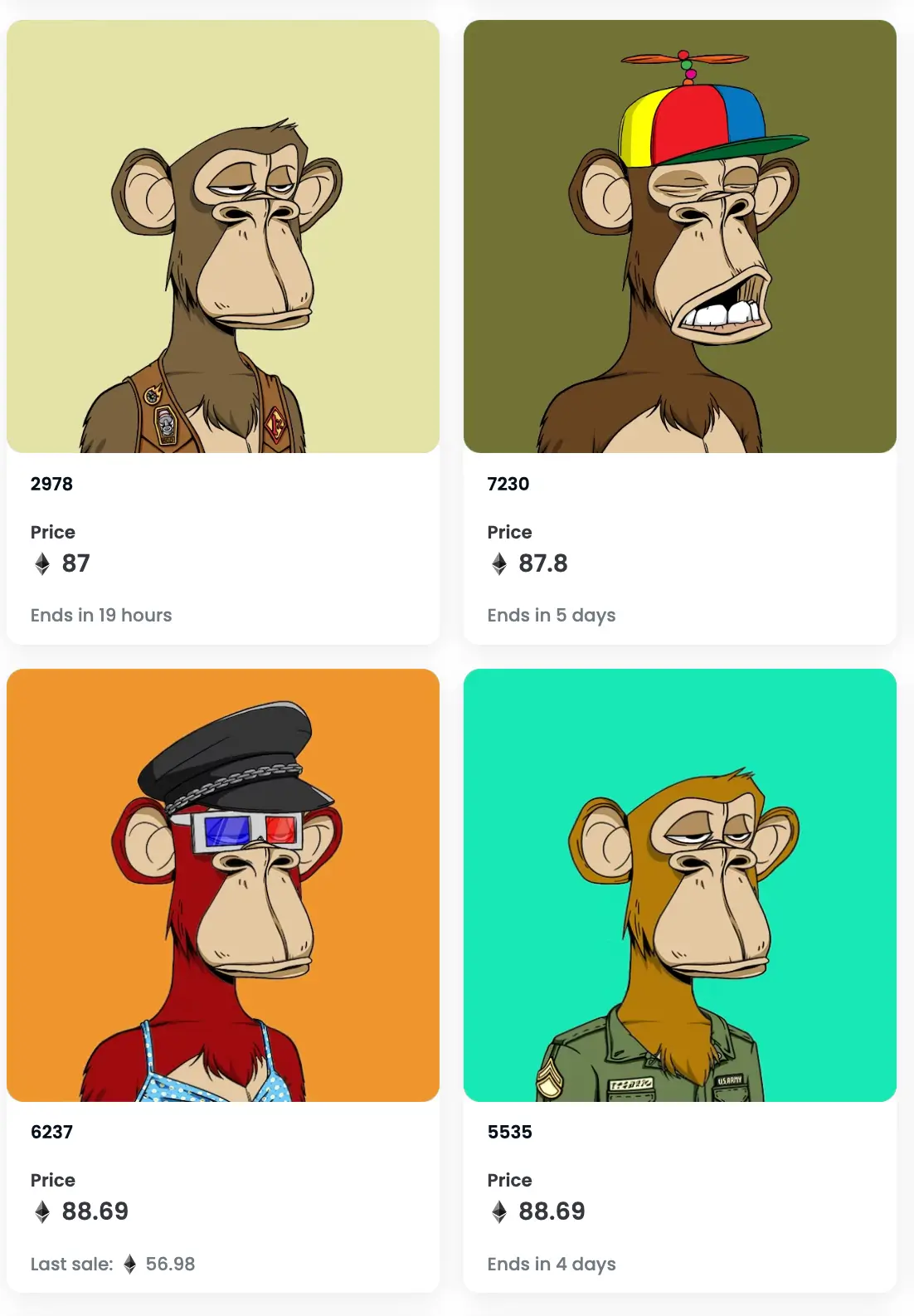

A large amount of the collateralized loans on BendDAO were backed by Bored Ape Yacht Club (BAYC) NFTs. Here’s the problem: BAYC is down massively. The BAYC floor, the lowest price to buy an item in the collection, peaked at 153.7 ETH. It’s currently sitting at 72.5 ETH.

This pricing slump led to some liquidations in BendDAO, and a large amount of loans being at risk of liquidation. Overall, about $5.3M in BAYC NFTs were at risk. This scared BendDAO’s lenders, which resulted in them withdrawing their ETH in what can only be described as a bank run. BendDAO’s reserved went from over 10,000 ETH down to just 5 ETH.

Poorly designed liquidation protocols contributed to this fear. The mechanisms involved putting NFTs up for auction in a way that wouldn’t allow the DAO to take any losses–which makes it unlikely they will find buyers at the price they need.

What Next?

The core of the problem here is that BendDAO tried to treat an illiquid market like it was liquid. To resolve these problems, they’re introducing a number of changes. These include:

- Dropping the liquidation threshold from 95% to 70%

- Shortening the auction window from 2 days to 4 hours

- Removing the first bid limitation, which previously forced the first bid to be within 95% of the floor value

- Increasing the loan interest rate to incentivize depositors to stay invested and loan recipients to pay back their loans

It seems like Bend DAO’s emergency plan worked for now, and its treasury has recovered to about 5,000 ETH.