Coinbase and Gemini Kick Off the Crypto Winter Job Market

As economic concerns grow & retail interest wanes, exchanges are laying off employees, freezing hiring, & halting new development.

As economic concerns grow and retail interest in crypto wanes, centralized exchanges (CEX) are laying off employees, freezing hiring, and halting new development.

Earlier this week, Coinbase froze hiring and rescinded its outstanding offers of employment. The rescinded offers were especially surprising to Coinbase's most recent hires, because the company specifically emailed these people saying their offers were safe.

Coinbase sent a welcome email to new hires 2 weeks ago promising that they won't rescind offers (1st image).

— Blind (@TeamBlind) June 3, 2022

Yesterday, they sent the rescind emails (2nd image) leaving candidates in frustration.

We have a referral thread going on to help those who were impacted 👇 pic.twitter.com/lIQe0ph4rk

Even before it started to fire pre-onboarded employees, Coinbase had a very competitive hiring process. The company pays senior software engineers (3-8 years experience) an average of roughly $375k per year in cash and stock.

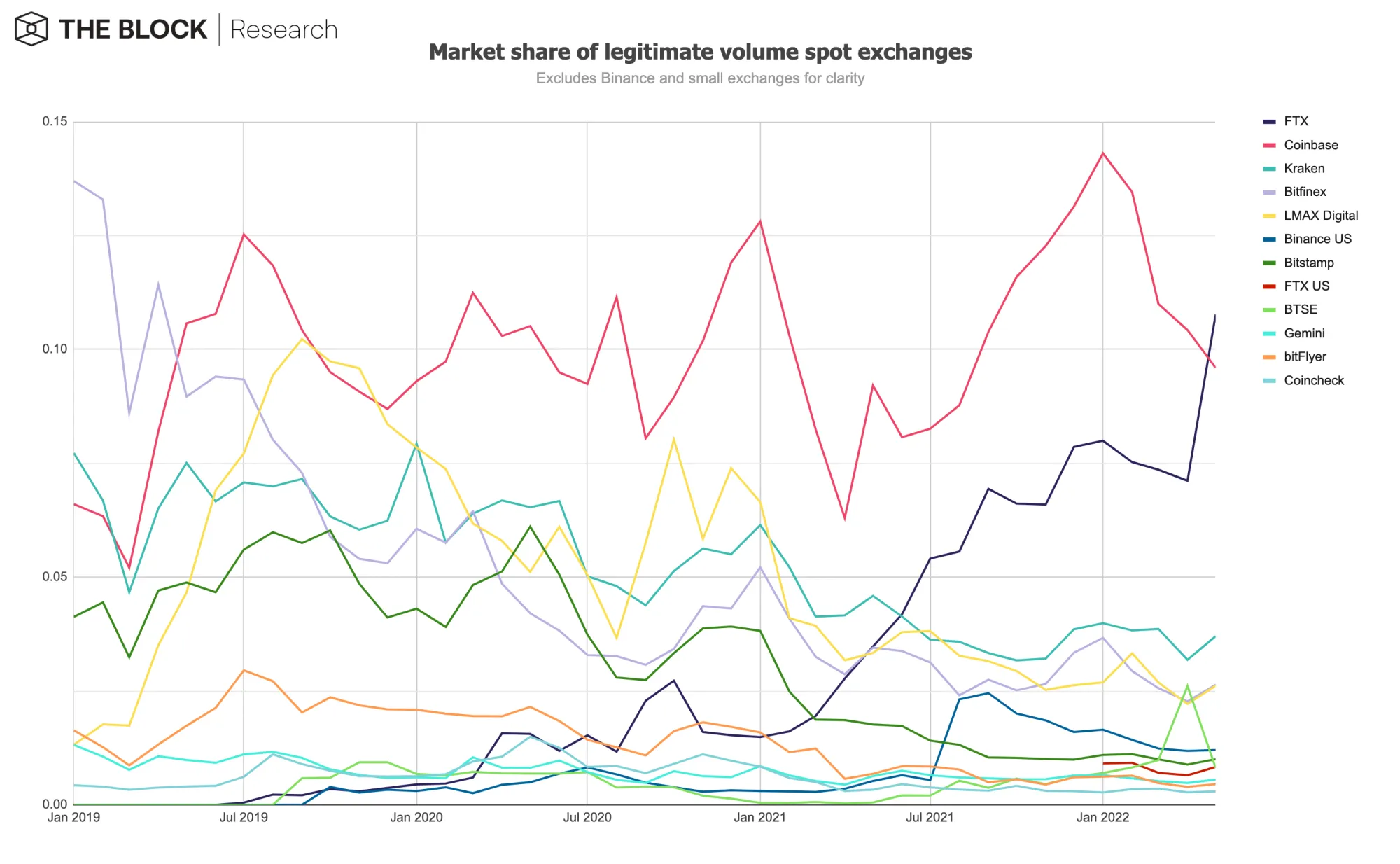

Coinbase is the only publicly traded major crypto exchange in the US, and in 2022 its stock has suffered. After starting the year around $265, Coinbase stock (NASDAQ: COIN) now trades for $66. The company expanded into NFTs with its new social NFT marketplace, but users have been slow to sign up. Recently, FTX passed Coinbase as the second-ranked CEX by volume, following Binance.

Gemini, the CEX run by billionaire twins Cameron and Tyler Winklevoss, is also laying off 10% of its staff. The Winklevoss twins announced the layoffs in a blog post on June 2, 2022. Gemini has been in operation since 2014, and this is apparently the company's first ever round of layoffs. The Winklevoss twins blame the current crypto trends and the macro environment for Gemini's slow business:

This is where we are now, in the contraction phase that is settling into a period of stasis—what our industry refers to as 'crypto winter.' This has all been further compounded by the current macroeconomic and geopolitical turmoil. We are not alone.

Ouch.