Crypto this week: from 🌋 BTC to Network ☠️

Crypto this week: from El Salvador's volcano mined BTC cities, to major Helium network outages.

ConsenSys Raises $200M at a $3.2B Valuation

New York based company ConsenSys raised $200M this week from investors including Coinbase Ventures, Marshall Wace, and HSBC at a $3.2B valuation. ConsenSys is well known in crypto for making MetaMask and the popular developer tool Infura. Over the past year, Infura grew from 100k to 250k users, and MetaMask hit a monthly user base of 21M.

The company plans to use the money to hire 400 new employees, expand their operations into Asia, and put more focus on driving the mainstream adoption of NFTs.

Beyond just the user growth making headlines, MetaMask has been in the news because CEO Joseph Lubin recently discussed. the possibility of launching a native token, and many users are hopeful they’ll make a profit from a MetaMask airdrop. While there is no promise of them launching a token, most recent token airdrops have been issued based on use. A strategy to get some amount of airdrop would be to transfer some tokens to the MetaMask wallet, do some swaps via their native token swap in the browser extension, and interact with web3 projects using MetaMask.

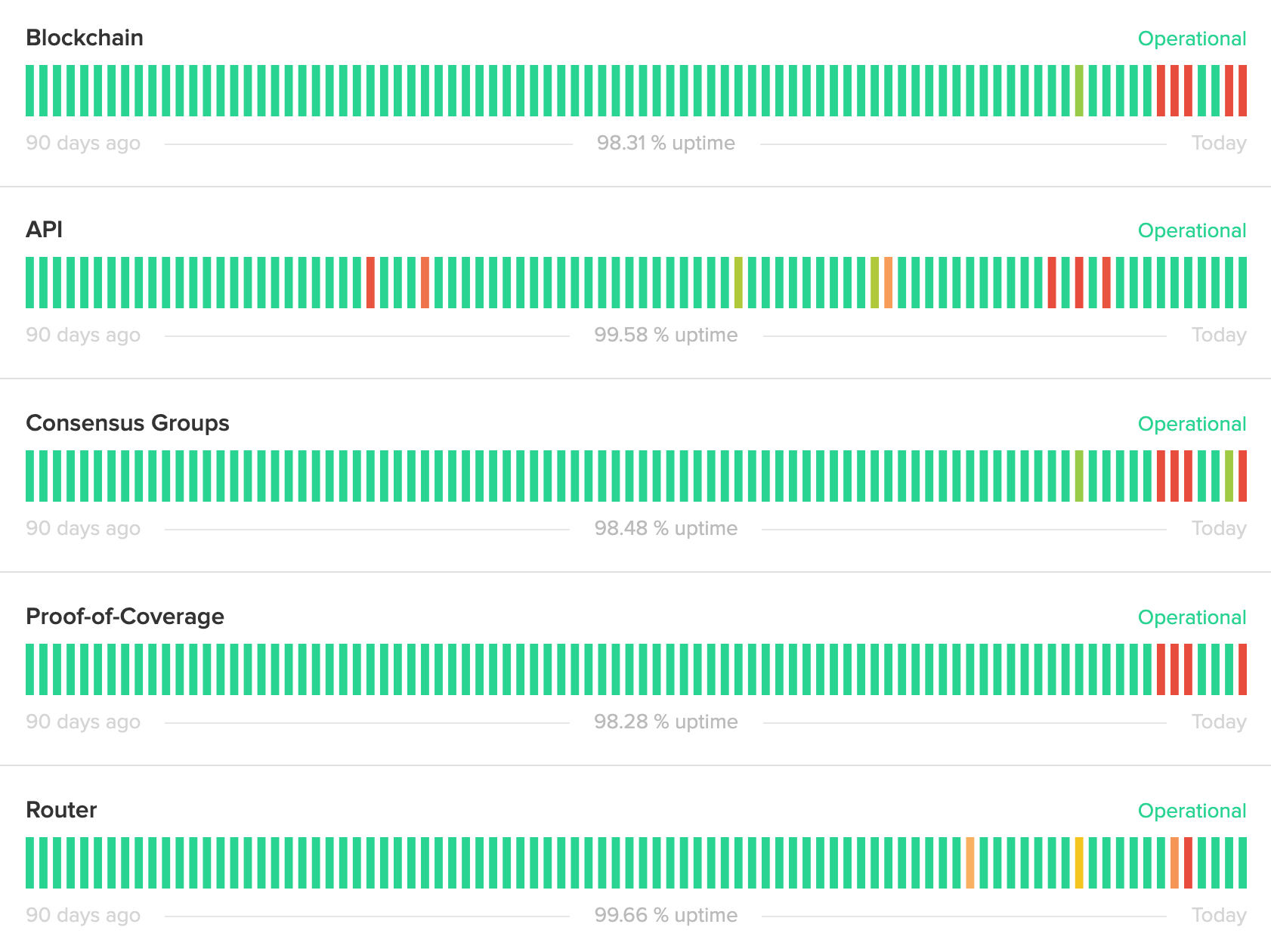

Major Helium Network Outages Continue

The Helium (HNT) network has been experiencing major outages for almost a week. Helium, the crypto that's mined using specialized Internet hotspot devices, first started to experience problems on November 15. Starting that afternoon, the Helium blockchain was halted for almost 30 hours. Helium's "Proof-of-Coverage" mining system was down for over 30 hours, and Helium routers were down for almost 20 hours.

Helium explained what happened in their Discord, pointing toward a technical error. Helium said, "the additional loading of a recently released chainvar caused a router instance to propagate many stale state channels which resulted in a large number of duplicated transactions. This large number of duplicated transactions has caused a bottleneck resulting in longer than normal block times."

Helium has been releasing software fixes for this issue since the outage, and the network, mining, and blockchain have been up more than down lately. But there are still ongoing problems. Outages continued across most of the Helium product line through the weekend, and miners with older hotspot devices are struggling to re-connect to the network.

Despite the customer-facing Internet network and its blockchain going down, Helium's token retained its value. The token's value has trended with the crypto market since the outages began.

Acala Wins First Polkadot Parachain Slot Auction

Acala (ACA) has won the first action for a Polkadot (DOT) parachain slot lease, used to interact with the main Polkadot blockchain. Acala locked up over $1.3 billion in DOT for 96 months after raising the funds through a crowdloan campaign with over 80,000 wallets participating.

Acala is an Ethereum-compatible smart contract platform on the Polkadot network. Acala offers a platform for bringing dApps to Polkadot, as well as an all-in-one DeFi solution for investors with low fee transactions payable in many cryptos. Acala's canary network, Karura (KAR), operates on Polkadot's canary network, Kusama (KSM). Like Acala, Karura's parachain slot was secured through a crowdloan.

Parachain Slot Auctions

Polkadot is a platform for making blockchains that use Polkadot's main blockchain for consensus. Projects on Polkadot use parachain slots to interact with the main blockchain. Acala explains, "the parachain slot auction is a way for blockchain startups to compete by bidding in an auction for the privilege of launching and operating on Polkadot while also benefiting from its security and connectivity to other blockchains."

Polkadot's technical capabilities limit the number of slots, and is currently auctioning 96-month leases for the first 11. Projects that win a parachain slot lease will lock up DOT tokens for the full term of the lease: 96 months. Some projects bidding for parachain slots are self-funded, while others rely on crowdloans.

Crowdloans

Bidding for the second parachain slot lease is open through November 25, so most crowdloan-funded projects will be accepting contributions through that date.

Moonbeam (GLMR), an Ethereum-compatible protocol, is the largest remaining project funded through a crowdloan. Moonbeam's canary network, Moonriver (MOVR), was the big winner of the Kusama parachain slot crowdloan projects. Crowdloan investors in Moonriver have received MOVR that today is worth roughly $5,400 per KSM contributed.

Based on current KAR values, Acala's canary network, Karura, paid $140 per KSM contributed in its crowdloan on Kusama. Acala also raised less overall DOT than Moonbeam, but the "candle" in the candle auction blew out during a period when Acala had contributed more DOT than Moonbeam.

El Salvador to Create Bitcoin City

It’s been two months since El Salvador was all the buzz for Bitcoiners by announcing they were making Bitcoin legal tender, and this week they pushed the envelope again. The president, Nayib Bukele, announced at a crypto conference that the country will be building a “Bitcoin City” with “0% income tax, 0% capital gains tax, 0% property tax, 0% payroll tax, 0% municipal taxes, and 0% co2 emissions.” The only taxes that will be levied on residents will be a value add tax (VAT).

Construction on the city will begin in 2022 near Tecapa volcano, and is planned to be a circular city with a port, and a central area acknowledging that the city is built around Bitcoin.

El Salvador also announced this week that the country will be raising ~$1B of “Bitcoin Bonds” in partnership with Blockstream. The money will be going half towards buying Bitcoin and half towards building infrastructure to mine Bitcoin. The country already has tests running to use volcanic geothermal energy to run Bitcoin mining operations. These bonds will have a five year lockup period, and will pay out a dividend annually. There are also plans to sell “Volcano Bonds” that will be funded by Bitcoin mining using volcanos.