🔥 Everything is on Fire

Everything is on fire this week---MATIC is burning tokens making it deflationary, Cardano's first DEX reports it won't work, Russia is all in on FUD, and SecretNetwork is funded.

SundaeSwap DEX: Our Launch Could Crash the Cardano Network

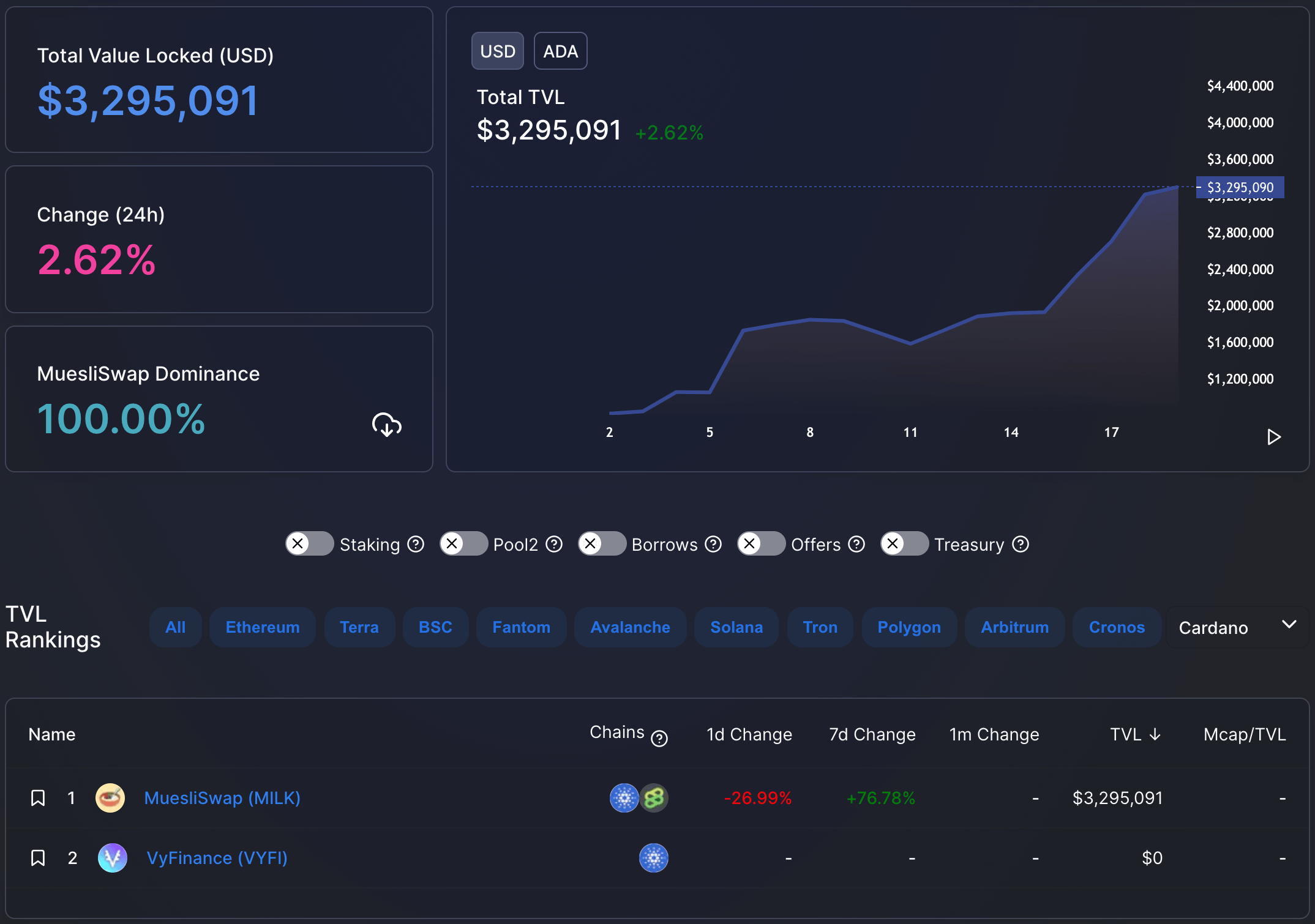

SundaeSwap (SUNDAE), the first major decentralized exchange (DEX) on Cardano (ADA), believes it could crash the Cardano network when it launches its mainnet on January 20, 2022. Cardano is a Layer-1 blockchain with a $47B market cap but only $3M* total value locked (TVL) in its decentralized finance (DeFi) ecosystem.

It is unclear if Cardano can scale to meet the volume of a top-10 crypto project's DeFi ecosystem–it just launched smart contract support in fall 2021. MuesliSwap (MILK) currently generates most of Cardano's DeFi volume, but with only $3M in TVL it's not a good test of the stress SundaeSwap will bring.

In a deleted Medium post, SundaeSwap lays out the complications it expects at release. During testing, the SundaeSwap devs claim that Cardano could only handle ~0.15 transactions per second (TPS). That's ~100x slower than Ethereum and ~65,000x slower than Terra!

SundaeSwap is adjusting their release to account for the Cardano network bottleneck:

“We are launching with a Beta label because [...] the implementation of fully decentralized governance will not be immediately possible due to existing transaction size limits on the Cardano blockchain.”

Since SundaeSwap is preparing for massive delays on the Cardano network, the devs have built out a feature set to help investors understand where their transaction stands in the expected days-long backlog:

"Because we expect a large backlog during the first days of the protocol, we will be building out features to inform users on what the current backlog is, what the current throughput is, and where your order roughly stands in the queue."

Despite the delays, the SundaeSwap devs believe their DEX will be able to handle all transactions fairly:

"While orders (including swapping, providing liquidity and withdrawing liquidity) may take days to process, everybody’s orders will be processed fairly and in the order they were received and executable."

To its credit, Cardano is addressing its scalability issues, but the project's dev team is notoriously slow to release updates. Cardano is expecting to roll out Hydra, a sort of Layer-2 scaling solution, this year.

Cardano will probably be fine. Even without DeFi, Cardano has remained a top-10 crypto by market cap. It's hard to imagine a few hiccups harming Cardano if they come at the cost of developing a DeFi ecosystem.

* The $3M figure excludes TVL in the SundaeSwap testnet.

Burns So Good: MATIC is Deflationary

On January 18th, Polygon (MATIC) rolled out their implementation of Ethereum’s EIP-1559 “London Hardfork.” An EIP is an Ethereum Improvement Proposal—essentially a code upgrade Ethereum, usually via a fork of the blockchain. EIP-1559 did a lot of nuanced changes, such as removing auction based fees in favor of fixed rate fees, and splitting up fees to be a base fee with a priority fee to speed up processing. This upgrade doesn’t change the amount paid in fees, but here’s why you should care:

- Fees are a lot more predictable

- Tokens are getting burned

Predictable Fees

In a post EIP-1559 world, there are two types of fees: the base fee and the speed priority fee. The base fee is calculated via supply and demand of block space, and is pre-determined when someone puts in a transaction. This means fees on transactions are a lot more predictable because the fee rate is already determined at the time of execution.

Feel the Burn

When the Ethereum token burning was implemented, people got really excited. Sites like Watch the Burn popped up to track how much has been burned, and the burn count went up fast—so far it’s just shy of $4B. Polygon followed suit and put out their own tracker, which so far has clocked nearly 400k MATIC burned or “Burn in Progress.” That’s equivalent to $600k in five days!

MATIC has a fixed token supply of 10 billion, so any amount of burn on MATIC makes the asset deflationary. The Polygon team believes roughly 0.27% of the total MATIC supply will burn each year.

In theory, an asset with high demand and progressively lower supply should result in price appreciation—an outcome that all investors, validators, and delegators on the Polygon network are hoping for.

Quick Hits:

- Robinhood may be the custodian of 31% of all DOGE. They deny it, but I'd deny owning DOGE too.

- Crypto markets have been smashed on Federal Reserve responses to inflation, with BTC down 18% and ETH down 30% over the past week.

- Fantom is winning the market crash, gaining 50% in TVL in their DeFi ecosystem over the past week. FTM is now the 3rd highest chain by TVL, behind ETH and LUNA.

Russia Gets in on the FUD

Last week, rumors in the Western world suggested Russia's Central Bank had called for a blanket ban on crypto transactions and mining, while maintaining that holding crypto would remain legal. If Russian crypto holders couldn't dump before the ban, roughly $92B would be locked up.

Early English-language articles noted that Putin disliked the energy usage of crypto because it went against Russia's green initiatives. Putin also noted that criminals use crypto, which he posed as a negative.

Following the initial rush of somewhat-incorrect information, we learned the report was from Russia's Federal Security Service (FSB), not its central bank. The FSB, while influential, is considered unlikely to see its proposed crypto ban actually happen.

It's difficult to imagine Russia completely banning crypto, and we have been subject to their government's FUD for years. Crypto allows governments to circumvent trade sanctions, and some observers believe that Bitcoin could overtake the US Dollar as the world's standard currency. Both situations seem to benefit Russia, but they also seem to benefit China, which has taken a strong anti-crypto stance.

Following the initial rumors, the head of the Russian Central Bank's Financial Stability Department, Elizaveta Danilova, publicly stated that "Restrictions on owning cryptocurrencies are not envisaged."

Under normal circumstances, I would trust a central bank leader's crypto stance to closely reflect the country's overall direction. Given Russia's perceived likelihood to invade Ukraine, it's possible that, at this moment, the FSB has more influence over crypto law than the central bank.

Following Fidelity's report that nations are stockpiling Bitcoin, some Reddit commenters suggested Putin may be intentionally manipulating the price of Bitcoin in order to buy more. While possible, these particular actions from Russia aren't necessary to drop the price of Bitcoin. Lately, Bitcoin has been trending with the stock market, and the stock market is not responding well to Omicron or Russia's near-term plans for Ukraine. If Russia does plan to stockpile Bitcoin, adding crypto FUD, while potentially helpful, was probably not necessary.

The Secret’s Out, It Only Cost $400M

Secret Network (SCRT), the privacy-by-default smart contract blockchain, announced this week that it raised $400M from major investors to grow its ecosystem. When Alameda Research announces they’ve invested in your round, the secret’s out.

Secret Network is a leader in the privacy coin space, a category of blockchains that try to push the amount of privacy available on a blockchain beyond the standard anonymous wallets. In Secret Network’s case, they do this by making the first smart contracts that are capable of being private by allowing encryption of everything involved. In most blockchains, everything about a smart contract is published publicly on the blockchain for all to see.

Secret Network’s $400M raise comes from a number of major firms: Alameda Research, DeFiance Capital, CoinFund, and others. These funds are being split into two segments: first, a $225M ecosystem fund “targeted at expanding Secret Network’s application layer (including DeFi and NFTs), network infrastructure, and tooling.”

The second being a $175M accelerator pool which is “designed to provide non-dilutive capital, grants, and ecosystem incentives to rapidly expand user adoption.”

This all comes on the tail of a strong year of growth for Secret Network. According to their roadmap announcement, the network has seen “record highs in active users, adoption, market capitalization, and TVL; substantial global community expansion; dozens of new partners and applications.” FTX, who shares a founder with Alameda Research, also launched trading of perpetual futures on the platform around the time of the announcement.