🏢 Bigger Institutions, Bigger Problems

Major institutions are coming to crypto (ETH in particular) in 2022, and they're projects to clear trillions in transactions.

The DTCC Wants to Bring Private Securities to Ethereum

The Depository Trust & Clearing Corporation (DTCC) announced it is launching its new blockchain platform. The DTCC is the world's largest securities clearinghouse, settling transactions worth trillions of dollars per day. The DTCC settles most securities transactions in the United States.

The DTCC is launching a blockchain platform to "digitalize and modernize private markets" in early 2022, pending regulatory approval. The DTCC believes private markets are siloed and inefficient; their plan is to bring the efficiencies of the public market to the private market, using tokenized private market securities and the blockchain for consensus. This plan was previously brought up in 2020's Project Whitney case study, which was "focused on exploring the potential for asset tokenization and digital infrastructure to support private market securities."

The DTCC is believed to be using a private blockchain based on Ethereum. There is no token, but analysts suspect there will be some form of "gas" fees for transactions.

Not everyone is pleased to have the DTCC involved in crypto. Reddit commenters noted that the DTCC is self-regulating and has some potential for corruption.

Institutional Money is Coming to Avalanche

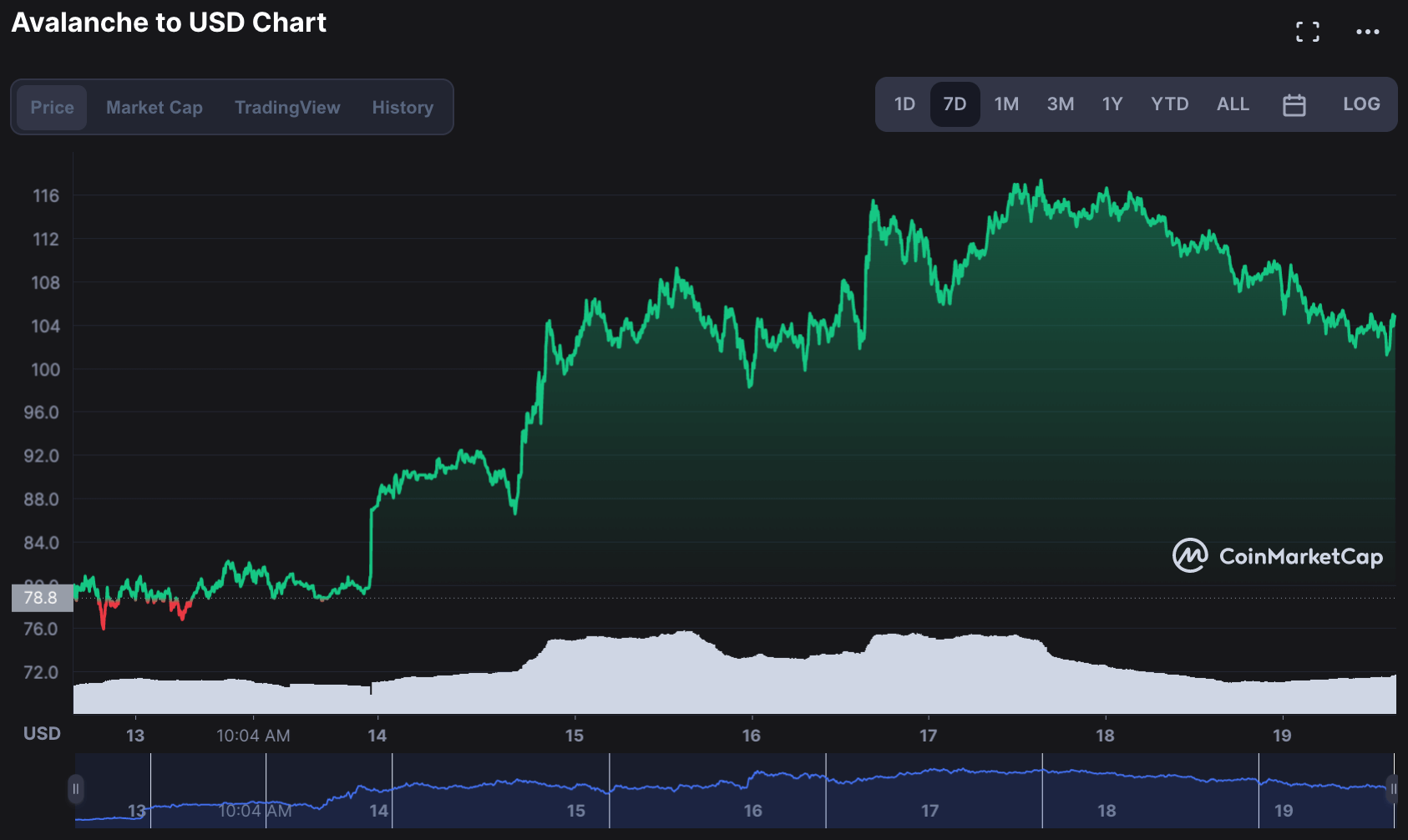

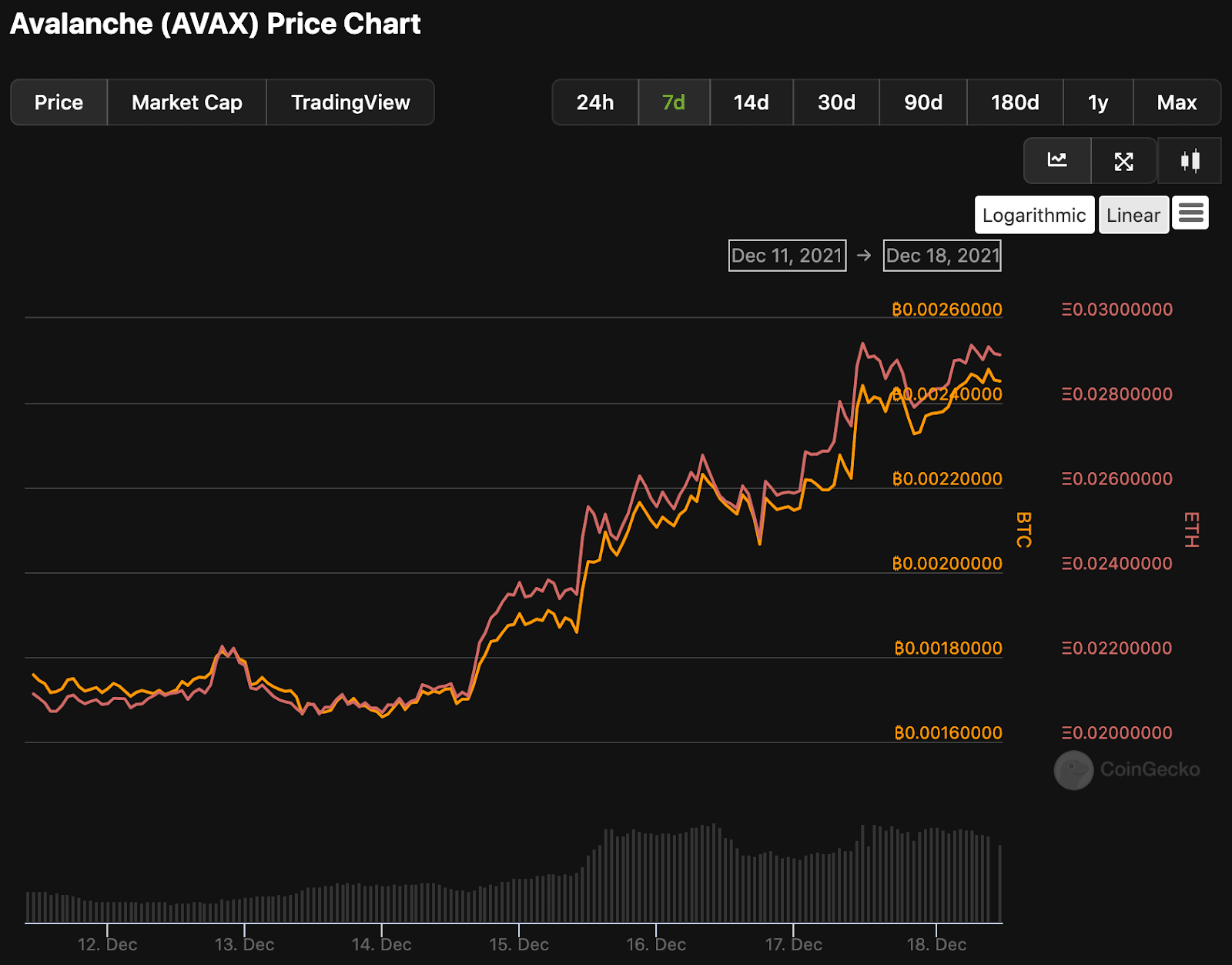

Avalanche (AVAX) is a fast, low-fee, Ethereum-compatible Layer-1 blockchain with a $27 billion market cap and $12 billion total value locked (TVL) in its DeFi ecosystem. Last week, Avalanche was added to BitGo, VanEck announced an AVAX-backed fund, and Circle launched USDC on Avalanche.

BitGo, a crypto exchange catering to institutional investors, announced support for AVAX and Avalanche C-chain cryptos. BitGo customers could inject significant liquidity into the Avalanche ecosystem. According to the Defiant, "BitGo has $64B under custody and processes about a fifth of all on-chain Bitcoin transactions by value. It’s keen on providing its well-heeled clients with access to Avalanche’s burgeoning ecosystem via its hot wallet and custodial products."

An Avalanche ETN (similar to an ETF) is coming to several European countries. The fund, offered by European investment firm VanEck, is called VanEck Vectors Avalanche ETN ($VAVA). VanEck says $VAVA offers "direct exposure" to AVAX, is 100% backed by AVAX, and is "tradeable like an ETF."

Circle launched USDC on Avalanche. Circle's US Dollar-pegged stablecoin, USDC, has over $40 billion in circulation.

Over the last week, the AVAX token's growth has outpaced the market, and AVAX is up ~30% against BTC and ETH.

Grim Finance Hacked for $30M

Over the past month, most cryptocurrencies have exhibited a sharp decline on the heels of a prior incredible market run. Among these, many DeFi-based tokens have been hit particularly hard. Grim Finance, a smart yield optimization platform used to increase DeFi returns, had been left unscathed... until now, as they’ve announced a $30M+ exploit.

Attackers found a vulnerability in the contract used for Grim Finance’s vaults, rendering all deposits therein at risk. The team at Grim Finance has since frozen all transactions with their vaults and are working to resolve the exploit. On Twitter, they detailed exactly how the exploit works and stated that they are unfreezing vaults on a 1-by-1 basis, so users should continue to try to withdraw their funds.

The exact exploit mechanism was covered in Grim Finance’s most recent security audit, raising questions around how this was possible. While nothing has been confirmed, members of the team confirmed on Discord that they were working on a compensation plan.

As of December 19th, Grim Finance’s token, $REAPER, is down 74%.

Due Diligence on Blockchains

This week, the guys over at Bankless dug into a mechanism to diligence cryptocurrencies: daily fees to issuance rates. The primary thing blockchains are “selling” is blocks (space to transact on the blockchain) and that is “paid for” in the form of transaction fees. One can calculate a daily income for a blockchain by way of the daily fees generated. The other side of this is viewing the amount blockchains pay people to secure the blockchain, either via mining, staking, etc, as their “expenses”. This is measured by the daily issuance rate of a blockchain – eg. how much of a token is printed and distributed to people helping to secure the blockchain.

Early in a blockchain’s lifecycle, one would expect the issuance rate to be much higher than the fee rate, and for that ratio to adjust over time as the ecosystem grows and the demand grows for blocks on the blockchain. Here’s a relevant breakdown of some of the largest cryptocurrencies:

| Blockchain | Issuance Rate | 7 Day Daily Fee Avg |

|---|---|---|

| Ethereum | $53,496,833 | $33,681,031 |

| Bitcoin | $41,104,684 | $510,344 |

| Compound | $1,558,634 | $795,684 |

| Aave | $707,168 | $1,225,690 |