🏈 Rappers, Hackers, and the Crypto Bowl

This week we cover $3.6B hacked Bitcoin being recovered by from a rapper, Russia adopting crypto, the crypto bowl, and the future of privacy blockchains.

Bitfinex Hackers Found, Bitcoin Recovered

In one of the craziest developments in crypto history, US federal agents arrested a husband and wife couple this week for attempting to launder 120,000 stolen Bitcoin – the Bitcoin that was hacked from Bitfinex in 2016. This 120,000 Bitcoin equates to roughly $3.6B, which is the largest financial seizure by the Feds ever. At the time of the theft, the Bitcoin was only worth $71M.

The Couple

Ilya Lichtenstein, 34, was a tech company founder who attended the top startup accelerator, YCombinator, in 2011 with his company MixRank. MixRank automates sales lead-generation. He has dual citizenship in the US and Russia.

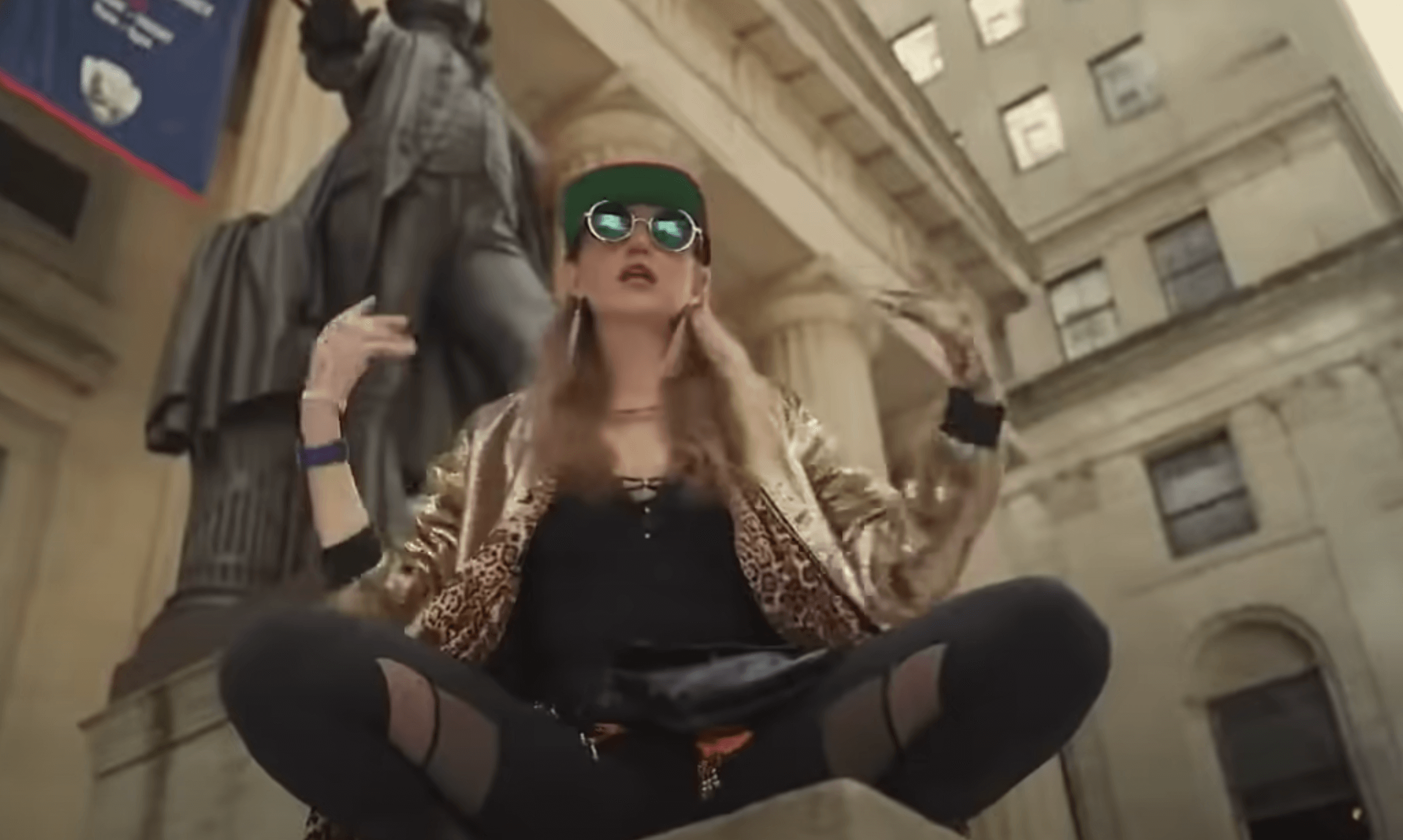

Heather Morgan, 31, was a CEO at SalesFolk, a columnist for Forbes, and a budding internet rapper going by the name Razzlekhan. Her rap catalog includes gems like Badd bhech and Versace Bedouin.

How They Were Found

After Bitfinex was hacked, the stolen Bitcoin was sent to thousands of wallets and moved in a sophisticated manner to avoid detection, eventually landing on a site called Alpha Bay. Alpha Bay was eventually shut down by the Feds for facilitating illegal actions, which in turn led to the information that set authorities on the trail of Lichtenstein and Morgan.

The bust happened when investigators obtained a search warrant for a cloud-computing account where the keys for the stolen Bitcoin were stored. (Not your servers, not your keys, apparently.) According to the Feds, the couple had successfully laundered ~25,000 Bitcoin up to that point, turning those funds into gold, NFTs, and Walmart gift cards. They had employed a variety of methods to move the money, part of which included creating fake identities.

It’s important to note that the couple was not charged with hacking the exchange, just with laundering the Bitcoins. This could simply be due to a lack of evidence, but there is some evidence in the exchange history that the hacker may be a separate party.

The Outcome

While it’s unclear who has the rights to the recovered Bitcoin, there will definitely be a battle for it. Bitfinex issued tokens to affected parties when the hack originally transpired, so according to them, users have been made whole. Given the price appreciation of Bitcoin relative to Bitfinex tokens, many people are going to want their original holdings back. Bitfinex has stated that they plan on using 80% of the recovered tokens to buy up and burn existing tokens, assuming they are directly given to them by the US.

Russia Adopts Bitcoin, Will Tax Crypto

Russia and Bitcoin have long been partners in a highly contentious relationship. Today, news broke that they’re trying to save their relationship by getting married. A document posted on the official Russian government site announced that the country is planning on regulating and taxing cryptocurrencies. It detailed the allowance of trades through locally registered companies, as well as a requirement for investors to verify their identity and personal information, a system which much of The West knows as Know Your Customers (KYC).

The news comes with the support of the government and the Russian Central Bank, the latter of which called for cryptocurrencies to be banned outright just two weeks ago.

How Big Is The Russian Crypto Market?

According to the Russian government's report, there are 12 million cryptocurrency accounts in Russia. Russia has a population of 144 million, meaning that over 8% of Russia is already involved. These accounts collectively hold 2 trillion Rubles ($26.7B) in crypto. Russia is the world’s 11th largest economy.

The bigger story for Bitcoin itself may be the impact this news will have on stabilizing the mining network. Russia currently accounts for a third of all Bitcoin miners, a number which in part is due to the migration of Chinese miners to Russia following China’s cryptocurrency ban.

Adoption

Russia’s actions are part of a quickening pace of adoption of cryptocurrency by national economies – most notably El Salvador, but this announcement also comes on the tail of India changing their stance from antagonistic, to “adopt and tax.” There has been some speculation that Russia may be gaining interest in cryptocurrency as a way to skirt global sanctions.

In case this plan goes poorly, they could always try to save the marriage by having a child – Russia is reportedly working on a digital Ruble.

Why Super Bowl LVI is Being Called the "Crypto Bowl"

Super Bowl LVI has been dubbed the "Crypto Bowl," according to Fortune. The name, "Crypto Bowl," is a nod to the year 2000's "Dot-Com Bowl," in which 14 tech companies paid roughly $44M for Super Bowl ads just before the dot-com crash that wiped most of them out.

NBC, which will be broadcasting the Super Bowl, is expected to run 80-90 ads during the game. According to University of Delaware marketing professor John Antil, "five or six crypto companies will be featured in Super Bowl commercials this year." While this year's Super Bowl will certainly have a Crypto theme, it won't be quite as prominent as Tech was in the Dot-Com Bowl.

Companies expected to run ads include:

- Coinbase (NASDAQ: COIN), the most popular centralized exchange (CEX) with US customers

- FTX (FTT), a CEX open to US customers that also offers a native token

- Crypto.com (CRO), a CEX open to US customers that also offers a native token

- BitBuy (Canadian broadcast), a Canadian CEX

What’s more, Binance paid pro basketball player Jimmy Butler to tell investors to do their own research, and “learn crypto and trust yourself.” It's unclear if Binance will run a Super Bowl ad, or if the Jimmy Butler tweets constitute the CEX's Super Bowl advertising efforts.

Marketing analysts believe the Super Bowl will help crypto reach a more mainstream audience. The game is expected to draw around 100M viewers, with around 40M in the 18-49 age range that crypto companies are targeting. This year, NBC is charging $6.5-7M for a 30-second ad spot. The NFL is rumored to have capped the number of sportsbook ads that NBC could run during the Super Bowl; it’s possible the league placed a similar limit on the number of crypto ads in this year's broadcast.

Although it's difficult to find a direct connection between a Super Bowl ad and business success, Katie Thomas of the Kearney Consumer Institute believes this year's run of crypto ads could produce measurable growth in mainstream crypto adoption.

Oasis Leads the New Generation of Privacy Blockchains

Although Bitcoin has a reputation for being popular with criminals, transactions on Bitcoin and most other blockchains are not private. Anyone can audit the entire Bitcoin blockchain, accessing all transactions and wallet balances. Governments pay blockchain analytics firms to identify and track funds on Bitcoin, Ethereum, and dozens of other blockchains.

Privacy-focused blockchains offer investors the ability to perform transactions in a way that doesn't record data about the parties involved in the transaction or how much money was sent. Just as with public blockchains, non-crime uses for private blockchains are emerging, such as anonymized corporate data marketplaces.

Popular Privacy Blockchain Projects

Monero (XMR), $3.2B market cap

Monero is a decentralized, peer-to-peer "digital cash" project that operates like a "private Bitcoin." The proof-of-work blockchain is popular with crypto enthusiasts, having launched in 2014 with no VC funding and no XMR tokens pre-mined and saved for investors and developers.

Monero uses "stealth addresses," where a sender in a transaction uses a one-time address for every transaction. The protocol also employs "ring signatures," which makes the source of assets in a transaction untraceable. Monero splits transfers into smaller portions and treats each as its own transaction with its own address, further obscuring the size and parties involved in all Monero transactions.

Zcash (ZEC), $1.6B market cap

Zcash bills itself as a "private Bitcoin," but it transitioned to proof-of-stake in 2021. Zcash secures transactions using Zero-Knowledge Succinct Non-Interactive Argument of Knowledge (zk-SNARK) proofs. As Zcash explains, “Zero-knowledge” proofs allow one party (the prover) to prove to another (the verifier) that a statement is true, without revealing any information beyond the validity of the statement itself," meaning Zcash allows both parties in a transaction to send ZEC without revealing their addresses to each other. This process also obscures the amount of ZEC sent in a transaction.

Oasis (ROSE), $1.2B market cap

Oasis brings privacy to the modern crypto ecosystem. The proof-of-stake blockchain uses a "paratime" scaling architecture, similar to Polkadot's parachains. Projects built on Oasis use the Oasis blockchain for consensus and their own blockchains for handling transaction execution details, such as minting an NFT or a DeFi swap.

Oasis has seeded its DeFi and NFT ecosystem with a $200M fund, and its Ethereum-compatible Paratime, Emerald, is now live.

Oasis also offers a market for "data tokenization," where companies can anonymize and sell their data. Project participants include Binance's CryptoSafe Platform, Nebula Genomics, and a "Fortune 500 healthcare provider."

Iron Fish (IRON)

Iron Fish is a buzzy new "digital cash" proof-of-work blockchain that has raised $5.3M in funding. Iron Fish describes itself as "a privacy-first cryptocurrency that anyone can use, without compromising on privacy or usability." The project intends for miners to be able to run an entire node on a retail computer. Iron Fish secures transactions using zk-SNARK for privacy and the Sapling protocol.

The Iron Fish network is currently in testnet phase 1, and investors can earn IRON by mining the token or promoting the project on social media.

How was today's email?