This Week In Crypto

Last weeks crypto news including new DeFi ecosystems, GameStop's rumored partnership with Loopring, and Reddit bringing web3 to 500M users.

Axie Infinity, VeChain, and Stellar Lumens Expand Their DeFi Ecosystems

Three major altcoins are expanding their DeFi ecosystems. Axie Infinity's sidechain, Ronin, launched its own decentralized exchange (DEX) and token. VeChain's primary DEX, Vexchange, will soon offer yield farming. Stellar Lumens has added support for automated market makers (AMMs) and DEXs to its ecosystem.

Axie Infinity (AXS) - $9.9 billion market cap

Axie Infinity is the most popular blockchain game. Users collect, breed, and fight NFT characters, similar to Pokemon. Axie's governance token, AXS, operates on the Ethereum network. In response to Ethereum network fees and congestion, Axie also operates a sidechain called Ronin.

Last week, Ronin launched its DEX, called Katana. Katana allows players to swap Axie tokens without bridging to Ethereum. Currently, Katana supports Axie's in-game rewards token, Smooth Love Potion (SLP), AXS, Wrapped Ethereum (WETH), and USDC. Investors can also yield farm these assets to earn RON tokens, the new Ronin ecosystem token that "will eventually power all transactions."

VeChain (VET) - $10 billion market cap

VeChain is a fast, low-fee blockchain designed for non-fungible tokens (NFTs) and enterprise use cases. Although VeChain has significant real-world supply chain adoption, it's DeFi ecosystem is underdeveloped.

Vexchange, VeChain's main DEX, announced it will form a decentralized autonomous organization (DAO) and offer a governance token, called VEX. Soon, the new Vexchange DAO will set exchange fees and yield rates. Vexchange is expanding its DeFi offerings and will offer yield farming in the coming weeks.

Stellar Lumens (XLM) - $8.8 billion market cap

Stellar operates a low-fee platform for issuing and exchanging digital currencies worldwide. Stellar operates like a "global Venmo," and it has over 5 million accounts registered.

Stellar has partnered with projects to produce the first generation of AMMs, DEXs developed within the Stellar ecosystem. Stellar explains that DeFi will be integrated into its core functionality as a worldwide transaction network:

"Cross-border payments leveraging AMMs will utilize liquidity pools if the rate is better than what is available through Stellar’s decentralized exchange. Trades executed against a liquidity pool will get the best available rate on Stellar, to the benefit of both those making cross-border payments and the liquidity providers."

Loopring Takes Off On Rumors of Powering GameStop NFT Marketplace

Since GameStop’s short squeeze earlier this year captured the attention of the internet, the company has been trying to figure out how to capitalize on all the attention. One of the things they hinted at was getting involved into NFTs---they even started listing roles for engineers and analysts familiar with cryptocurrencies. There was no clear announcement for what this project would be, some guesses were minting NFTs or adding tokens to their platform. Now those rumors are picking up more steam as code from Loopring, a zkRollup L2 scaling solution built on top of Ethereum, has leaked code that points towards them being involved in an NFT marketplace for GameStop.

In April Loopring’s Head of Business, Matthew Finestone, left the company and joined GameStop as the Head of Blockchain. In his letter to the community, Finestone wrote about the opportunity saying “I view it as a once-in-a-lifetime, perfect-timing, far-reaching opportunity/challenge that I need to pursue for its own sake, and for my personal development. I cannot give more information at the moment, but I will be sure to do so when the time is right — I hope in the order of a few months. This opportunity will keep me firmly in the blockchain (Ethereum) space...”

Loopring (LRC) is up nearly 200% since these rumors came out last week, and is currently sitting at a market cap of $1.8B.

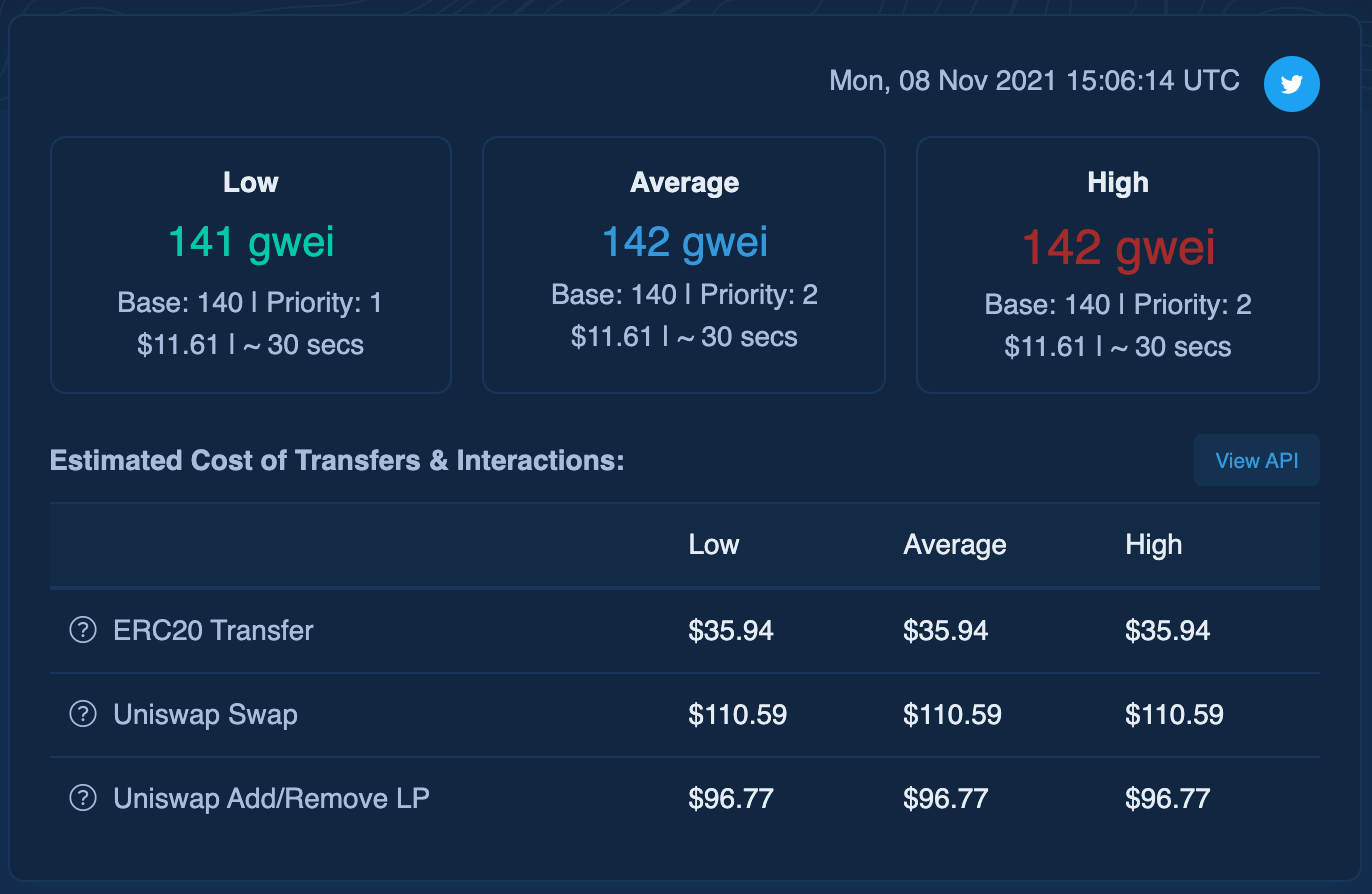

Ethereum Leads All Blockchains in Block Sales

A “block,” or “block space" refers to the storage space in a blockchain. In order to use a blockchain, investors and crypto projects need to buy space on the chain to store their information. A "network fee" is money paid to the crypto's miners in exchange for adding information to the blockchain.

A layer-1 (L1) blockchain is a "main" blockchain, such as Ethereum. A layer-2 (L2) blockchain works on top of an L1, usually to offer cheaper and faster transactions with consensus maintained on the L1 blockchain. Polygon (MATIC) is an Ethereum L2.

Ethereum L2s have exploded in popularity this year as the Ethereum network grew more congested, growing to almost $5 billion in total value locked (TVL) after starting the year around $50 million TVL.

Applications buy blocks in blockchains to help operate their own blockchains. Ethereum sells block space primarily to other applications. Ethereum’s massive fee income comes from the gas fees paid for transactions on the Ethereum blockchain. Polkadot and Kusama lease parachain slots to companies that in turn sell that block space to other projects. These projects generate enormous income from their blockchains, their daily fee income is relatively modest.

Rankings from Crypto Fees:

- Ethereum (ETH) - 7 Day Average Fee Income: $67 million per day

- Binance Smart Chain (BNB) - 7 Day Average Fee Income: $5 million per day

- Bitcoin (BTC) - 7 Day Average Fee Income: $1 million per day

- Arbitrum One - 7 Day Average Fee Income: $170,000 per day

- Optimism - 7 Day Average Fee Income: $157,000 per day

- Avalanche (AVAX) - 7 Day Average Fee Income: $107,000 per day

- Fantom (FTM) - 7 Day Average Fee Income: $84,000 per day

- Polygon (MATIC) - 7 Day Average Fee Income: $57,000 per day

- Solana (SOL) - 7 Day Average Fee Income: $43,000 per day

- Cardano (ADA) - 7 Day Average Fee Income: $37,000 per day

It's clear that Ethereum blocks are worth the most, considering Ethereum's staggering lead in fee income and the considerable amount of money locked into its L2 projects. It’s also evident that low-fee networks like Solana struggle to generate significant fee income.

Reddit to Roll Out Site Wide Crypto Based Karma

Reddit recently hired a blockchain engineer, Rahul Kothari, who posted on Twitter some unconfirmed plans that Reddit is working on with their blockchain team. These plans include moving over to a decentralized system that would allow for forking their communities like you would a blockchain, and migrating their karma system, where users get points for comments or posts that have been upvoted by other users, over to a system backed by crypto tokens. Reddit has already introduced their token system, Community Points, and the subreddit community /r/cryptocurrency rewards crypto tokens called Moons. Moons have a market cap of $14.4M.

This is poised to be the largest migration from web2 to web3 as of yet with 500M registered Reddit users that could be brought into the fold. Many people are excited about this recent movement in social media because it allows users to profit from the content they create for the sites. To build the infrastructure for this, Reddit has partnered with Offchain Labs, the makers of Arbitrum, the Optimistic Rollup L2 scaling solution for Ethereum. Rahul even calls out that “Everything will be permissionless, open-source and decentralized.”

Reddit isn’t the first social media platform to work on crypto based solutions. Twitter and its CEO Jack Dorsey have also publicly talked about moving to decentralized, open solutions by integrating with blockchain technologies. Beyond them, there are new decentralized first social media sites launching like BitClout and their underlying token, DeSo.