Crypto This Week: Feuds & Funding

This week in crypto is all about funding and feuds---China v Media and Crypto, Winklevoss twins v Zuckerberg, StarkWare raising $2B, and Ronin Bridge moving $7.5B.

China Censors Crypto Media and Restricts Domestic Mining

China continues its assault on crypto, as The Block reports that China is censoring crypto media. CoinMarketCap and CoinGecko have been blocked in China for months, and now Chinese crypto news outlets are being censored.

China has shut down, blocked, or removed the mobile apps and websites for most major crypto news outlets, including Chainnews, ODaily, and BlockBeats. Chainnews, a major Chinese crypto news service, announced it will be shutting down completely. Other outlets have moved to new websites and group chat apps.

The Chinese government has also taken further steps to restrict crypto mining. China had previously banned mining, leading to a massive decrease in mining within the country. Chinese Internet service providers (ISP) are now believed to be capable of blacklisting "domestic miner IPs that have communicated with mining pools' URLs." The ISPs can cut off the internet to miners’ IP addresses and blacklist mining pool URLs. This development is believed to be responsible for a rapid 10% decrease in hash rate for Bitcoin and Ethereum.

In addition to crypto, China is cracking down on foreign influences. Recently, the Chinese government has banned the Marvel movie Shang-Chi, blacklisted actress Zhao Wei by removing all her social media from the internet and all her shows from streaming services, and restricted fan accounts of K-pop bands on social media.

Blockchain Services Firm StarkWare Raises at a $2B Valuation

StarkWare, an Israeli blockchain services firm, announced it raised a Series C equity round at a $2 billion valuation. StarkWare had previously raised about $112 million, including a Series B earlier this year. This is the first time StarkWare has announced its valuation, and Co-Founder and CEO Uri Kolodny calls this an "opportunistic" raise. The blockchain services sector is growing fast, and some analysts believe it could grow 1,000% or greater over the next five years.

For a $2 billion crypto company, StarkWare is not well known, but customers of its STARK software stack have been successful, including:

- dYdX (DYDX), an Ethereum L2 with a $674 million market cap and $941 million in total value locked (TVL)

- ImmutableX (IMX), an Ethereum L2 for games and NFTs with a $1.3 billion market cap and $216 million TVL

- DeversiFi (DVF), a DEX with a $285 million market cap and $76 million TVL

- Sorare, a global soccer fantasy trading card NFT game with $21 million TVL

StarkWare claims it has handled over $215 billion in trades and over 51 million transactions since it launched.

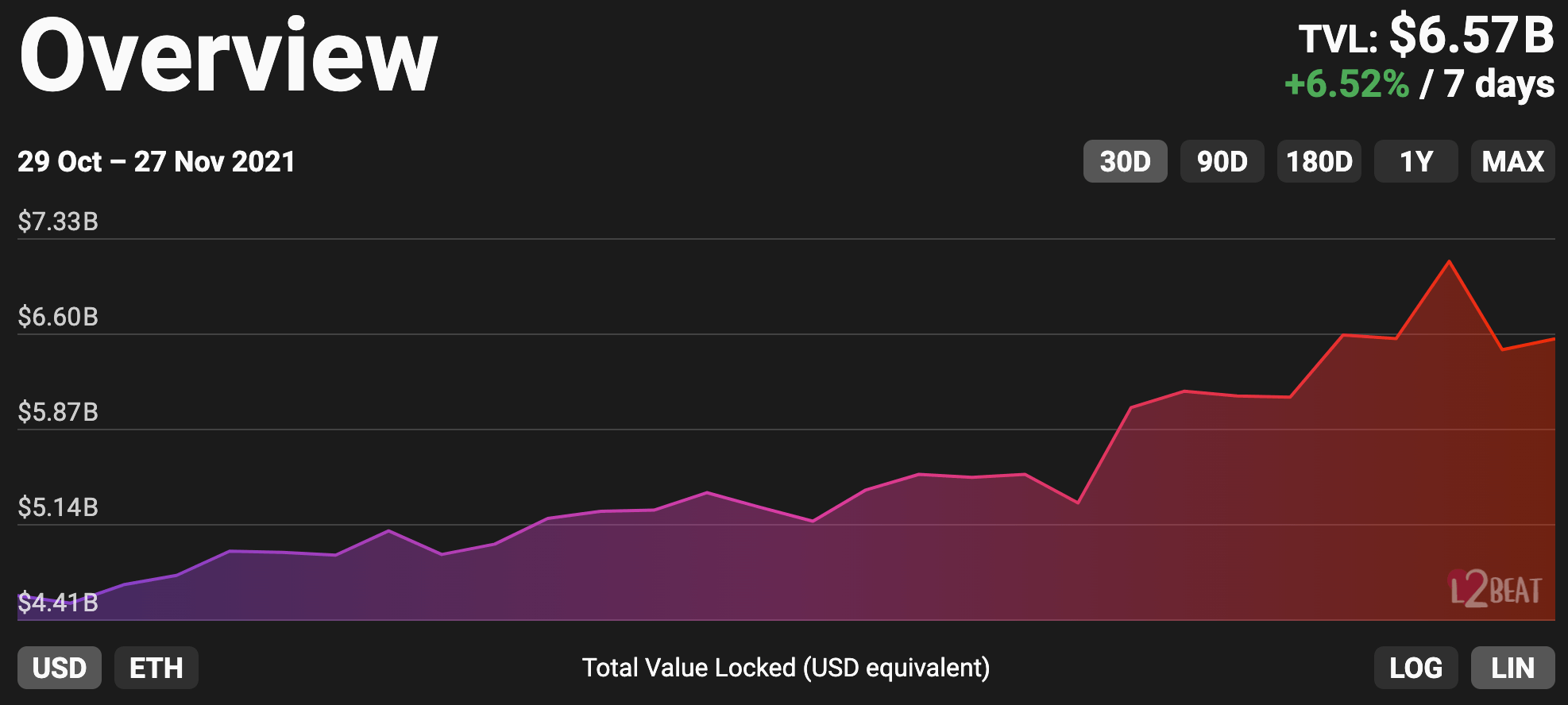

StarkWare joins Metis and Maker in capitalizing on Ethereum’s high gas fees, which are encouraging growth in Ethereum L2s. The TVL into Ethereum's L2s has grown roughly 50% in the last month despite the price of ETH stagnating. If this trend continues, along with growth in the blockchain services sector, it's easy to see how StarkWare's investors justified a $2 billion valuation.

StarkWare has no native token and it has not commented on when a token might be released.

Winklevoss Twins vs. Zuckerberg (Part II)

For the past seven years, the Winklevoss twins have been funding Gemini – one of the top crypto exchanges – out of their own pockets. Recently, that changed when they raised $400M for the parent company of Gemini, Gemini Space Station. They are expected to retain 75% of the company and nearly double their net worth to $10B. A month ago, Facebook rebranded to Meta, and has said they are setting their focus on building out the metaverse. There isn’t a clear definition of what the metaverse is, but the general idea is that it will offer a digital world, like a video game, wherein operations will be fully compatible with other digital worlds. Presently, users are restricted from taking items from one game to another, but in the metaverse, everything would be compatible.

Controversy exists with regard to the means by which Zuckerberg intends to construct the metaverse. In the world of crypto, where the Winklevoss twins live, the metaverse is meant to be open and available for anyone to build on, allowing seamless transitions between different apps. Zuckerberg’s vision, however, entails placing the metaverse within the walled garden in which other Facebook games reside. Meta is largely focusing their efforts on virtual reality, committing $2B to their subsidiary Oculus, which makes VR headsets.

Ronin Bridge Has Moved $7.5B in the Past 30 Days

Earlier this year, Sky Mavis (the company behind the top play-to-win crypto game built on Ethereum) launched their Ethereum sidechain: Ronin. This launch was predicated upon an attempt to circumvent the high and volatile fees that have been plaguing Ethereum. Axie Infinity has already sold billions in NFTs to play its game, which has subsequently sparked the creation of many other crypto projects like Yield Guild Games and become a major source of income for people in lower income countries like the Philippines.

Earlier this month, the company launched Katana, the first Dex (decentralized exchange) built on Ronin. In the two week that the Dex has been available, Ronin has seen $1.8 billion in net assets transferred from Ethereum (ETH) to Ronin (RON). Beyond just the total value locked into the Katana Dex, the bridge between Ethereum and Ronin has been the most used Ethereum bridge, recording $7.5 billion in volume.

The launch of Katana brought Axie’s Smooth Love Potion (SLP) up 74%, a token which is rewarded for in-game play. Katana offers most of the features that we’ve come to expect from Dex’s, like swaps, pooling, and farming assets for returns (in RON).