This Morning On Chain

This week in Crypto: Identity tracking, SEC regulation, Bored Ape launching a token, DAOs, and Polkadot's Parachain Slot Auction

Identity Tracking on the Blockchain

US tech giants are driving adoption of a new type of identification that uses the blockchain. The Decentralized Identity Foundation, W3C, IBM, and Microsoft are involved in producing and managing an open source Decentralized Identity (DID) standard.

Decentralized Identity (DID) on the blockchain can be used by blockchain projects to identify users in order to meet regulatory requirements and decrease risk of hacks. Internet of Things (IoT) devices can also be managed using blockchain identities. Proponents of DID also claim that blockchain identification can help the 1 billion people who do not have access to any other form of identification, although one would assume these people's access to crypto may be limited.

Microsoft will use their own version of blockchain IDs on InterPlanetary File System (IPFS) for its product line. For non-Microsoft customers, several new companies have gained traction in the Decentralized Identity blockchain space:

Ontology (ONT) ($888 million market cap) - Ontology is a blockchain for self-sovereign ID and data on the Binance Smart Chain. Ontology's ONT ID app is used by over 1.5 million end users to log into apps, and 300 dApps use the corresponding business product for data ownership and authenticity verification. Ontology also operates a decentralized data exchange framework and several other products.

Civic (CVC) ($340 million market cap) - Civic offers KYC & AML compliance solutions for DeFi projects. Their product line covers age verification, multi-factor auth, and bot prevention for NFT mints. Customer crypto projects pay Civic in fiat for their services. The CVC token is the currency exchanged in a verification transaction.

Metadium (META) ($145 million market cap) - Metadium is a public identity blockchain platform on the Ethereum network. Metadium offers an app for end users to log into other apps, a survey product called THEPOL, and a Unity SDK for decentralized identity management for mobile games.

SEC Chairman Says the U.S. Won’t Ban Cryptocurrencies

This week on the U.S. regulatory side, SEC Chair Gary Gensler has clarified his department’s stance on cryptocurrency by explicitly stating that the SEC will not be making any moves to ban cryptocurrency (as China recently did). This comes on the heels of a number of regulatory actions by the SEC, such as their ongoing case with XRP, their recent public conflicts with Coinbase, charging the BitConnect founder with $2B of fraud, etc.

On Tuesday, in a House Committee on Financial Services hearing, Representative Ted Budd explicitly asked Gensler if the SEC supported China’s bans, and if the SEC would consider similar measures. Gensler said his department was focused on: bringing cryptocurrency into the fold with financial regulations and consumer protection, enabling the Treasury Department to limit money laundering and enforce proper taxation, and limiting the risk that tools such as stablecoins posed to the financial markets. He went on to say that his department doesn’t have the power to ban cryptocurrencies and that a move like that would have to come from Congress. He stated that in many cases, crypto tokens pass the test to be considered “...an investment contract, a note, or some other kind of security.”

This mirrors the stance of Federal Reserve Chairman Jerome Powell, who earlier this month in a similar Financial Services Committee hearing on cryptocurrency said that there was “no intention to ban them.” Powell did explicitly call out stablecoins, saying they “are like money-market funds, they’re like bank deposits, but they’re to some extent outside the regulatory perimeter and it’s appropriate that they be regulated.”

TL;DR: The chairmen of the U.S. SEC and Federal Reserve have explicitly stated that they don’t intend to ban crypto, but rather to pull the currencies into the regulatory fold, easing the fears of many investors.

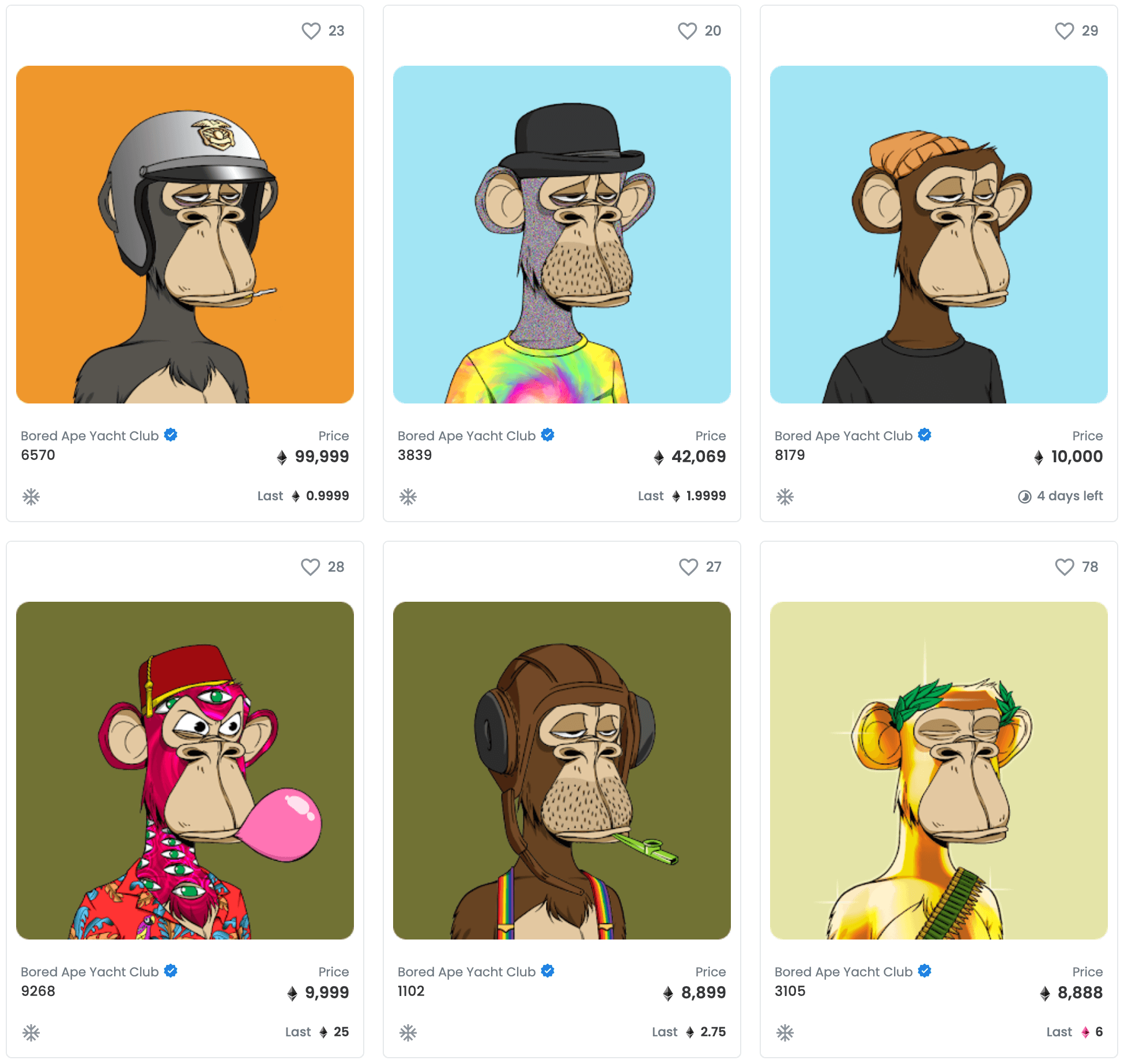

Bored Ape Yacht Club Announces Token for 2022

Bored Ape Yacht Club announced on Twitter that it will release an ERC-20 Ethereum token in Q1 2022.

Bored Ape Yacht Club is one of the most popular NFT projects on Ethereum, with a market cap of $1.3 billion. Owners of Bored Ape NFTs will likely receive the new tokens in an airdrop next year. The Bored Ape project promises a token with "dope utility and governance."

While it's easy to create and distribute an ERC-20 token, the Bored Ape project is stressing that this token will be "legally compliant," and they're working with Horizen Labs (ZEN) to help with the token launch. The token is expected to be used for governance of a possible decentralized autonomous organization (DAO) and potentially even a decentralized finance (DeFi) platform.

Bored Ape Yacht Club is one of the most successful NFT projects ever, and this token launch seems like a method of keeping the Bored Apes relevant without diluting the market by minting too many apes.

What Are DAOs?

Decentralized Autonomous Organizations (DAOs) can be thought of as internet-native businesses that are owned and managed by their members. They have a treasury directly associated with the DAO that has limited access; that is, a governance vote and approval by the members are required in order to make a change, removing much of the risk associated with having a bad actor in a traditional firm. The biggest strength of a DAO is arguably its ability to build trust in otherwise unknown members of a group. Members never need to directly trust other people in the DAO; rather, they need only trust in the DAOs code (which is open sourced). At the root of a DAO is simply a smart contract defining the rules of the group and its treasury. Just like any other smart contract, this one is published to the blockchain and is available for detailed review by anyone at any time.

Pulling directly from Ethereum’s article on DAOs, here’s a breakdown of a DAO compared to a traditional organization:

| DAO | Traditional Organization |

|---|---|

| Usually flat, and fully democratized. | Usually hierarchical. |

| Voting required by members for any changes to be implemented. | Depending on structure, changes can be demanded from a sole party, or voting may be offered. |

| Votes tallied, and outcome implemented automatically without trusted intermediary. | If voting allowed, votes are tallied internally, and outcome of voting must be handled manually. |

| Services offered are handled automatically in a decentralized manner (for example distribution of philanthropic funds). | Requires human handling, or centrally controlled automation, prone to manipulation. |

| All activity is transparent and fully public. | Activity is typically private, and limited to the public. |

DAOs come in all sorts of shapes and sizes, from investment groups to organizations making products, with all manner of governance rules. Two of the most famous ones are MakerDAO, the people behind the Dai stablecoin, and FlamingoDAO, an NFT-focused group of collectors, curators, and artists. FlamingoDAO has an extensive collection of NFTs which can be viewed here, which includes hundreds of CryptoPunks and some exposure in nearly every major project.

Polkadot's Parachain Slot Auction is Coming Soon

Polkadot (DOT) announced it will begin to auction parachain slots soon. Polkadot's canary network, Kusama (KSM), has already successfully auctioned off parachain slot leases in 10 auctions. Each slot is leased for a set amount of time, broken into 6-week segments, with a max of 48 weeks. Analysts expect the Polkadot main network to follow the same auction procedures.

2 Chains

Polkadot is a platform for making blockchains that are "tracked" by the main Polkadot blockchain, called the Relay Chain. Polkadot-based projects use the Relay Chain to verify and finalize transactions on their own chains.

Polkadot-based projects connect to the Relay Chain using Parachains. Polkadot artificially limits the number of Parachain slots to 100. This means that there are only 100 slots to connect to the Relay Chain. Projects can rent space from a company with a slot if they cannot afford to lease their own.

Kusama slot winners are locking up 100,000 to 200,000 KSM ($35-70 million) for 48 weeks to lease a parachain slot for the 48-week max. Participants in the auctions include projects like Moonriver (MOVR), an Ethereum-compatible blockchain for Kusama, and Karura (KAR), a decentralized finance and loans platform on Kusama.