⛓ War, Rug Pulls, and How to Farm

The best stablecoin yield farming spots, NBA rug pulls, how the crypto community is supporting Ukraine, and more.

Sotheby's Cancels CryptoPunks Auction

Auction house Sotheby's withdrew a lot of 104 CryptoPunks NFTs minutes before the auction began. In a deleted post on its website, Sotheby's estimated the lot would sell for $20-30M. Just as the auction was set to begin, Sotheby's canceled it. The owner of the collection, known only as “0x650d,” decided to keep his Punks.

Larva Labs released CryptoPunks in 2017 on Ethereum. Today, CryptoPunks is a top NFT avatar project among collectors, with over $2B in sales volume to date. The least expensive Punk for sale costs about $200k.

Sotheby's planned a party for the auction, including a DJ wearing a CryptoPunk mask. They called the lot "Punk It."

According to CoinDesk, "the highest pre-bid offer was $14 million, which was also the reserve price." When an art auction is canceled at the last minute, it's usually because either a piece was sold privately before the auction, or because it is not expected to reach its target price at auction. As of this moment, it appears that Punk It! collection owner 0x650d still holds his Punks.

Speculators are suggesting 0x650d held the Punks to prevent a widespread correction in the high end NFT market. The collector purchased the 104 Punks for $7M in a single transaction in August 2021. If 0x650d was looking for a quick flip on these Punks, why cancel an auction with a good shot at bringing in $14M or more? From that perspective, it seems as if 0x650d has time to ride out the current market and/or owns an extensive collection of NFTs.

Sotheby's had good reason to expect this CryptoPunk auction to bring in record money. The auction house sold over $100M in NFTs in 2021. In September 2021, Sotheby's helped sell a collection of 101 Bored Ape Yacht Club NFTs for $24M. It's easy to see how, in a better market, Punk It! could have brought in $20-30M.

0x650d is not complaining. To explain the canceled auction, the collector tweeted "nvm, decided to hodl" followed by a few memes. It is unclear what 0x650d plans to do with the Punks.

Where to Farm Stablecoins? Our Top 5 Projects for 2022

With the recent geopolitical strife and economic volatility, many investors are opting to keep cash on the sidelines instead of being fully invested in the market right now. That may seem like a good idea, but even if you’re holding onto cash, you still have to worry about the rising rate of inflation. In the US, we’ve just passed 7% on the year. If you’re holding cash, that means you’re taking all of that as a loss. Historically, putting money in a bank savings account would help mitigate some of that real loss without too much work. However, with bank rates commonly at 0.1%, using a savings account as an inflation hedge is essentially pointless. Luckily, web3.0 has a solution for this: yield farming.

There are many DAOs and DeFi tokens advertising high rates of return. Absurdly high rates. Rates that obviously cannot be accurate. For instance, just two weeks ago when we wrote about TIME Wonderland, there were APY rates from DAOs like Wonderland promising 80,000%, or Klima promising 35,000%. And these aren’t random projects; they are substantial ones that you’ve heard of before. So how are they doing this, and why isn’t everyone rich?

Well, the way they’re able to offer these rates is by printing A LOT of tokens and handing them out. This is why prices of these tokens exhibit long term declines across just about every project that offers high rates and is fueled by minting tokens. They promise high rates to bring in investors, then print so many tokens that the market gets flooded and the price collapses.

If you want to keep your money as stable as the US dollar and you don’t want to dabble with these scammy market-flooding DAOs, then you’re looking for stablecoins. And since so much of the DeFi world runs off of stablecoins, there is actually a high demand for making them available. That means by offering your stablecoins, which should always be worth $1 each, to platforms, you can earn strong returns without much risk of asset depreciation. Here’s a list of some of our favorite spots to park stablecoins to earn real returns, while steering clear of the current volatility of the market.

| Site | Blockchain | Stablecoin | APY |

| francium.io | SOL | USDC | 3.53% |

| beefy.finance | Multiple | Multiple | ~5.00% |

| anchorprotocol.com | LUNA | UST | 19.44% |

| gemini.com | N/A | GUSD | 8.05% |

| crypto.com | N/A | USDC | Up to 14.00% |

NBA Player De'Aaron Fox May Have Rug Pulled His SwipaTheFox NFT Project

Pro basketball player De'Aaron Fox has temporarily shut down his NFT project, SwipaTheFox, after raising over $1.5M. Although Fox has suggested he will restart the project after the basketball season ends, some investors are calling Fox's treatment of SwipaTheFox a rug pull.

SwipaTheFox was an NFT avatar project on Ethereum that promised to be a "high utility NFT collection." The project was announced in December 2021 and went live on January 15, 2022. SwipaTheFox promised investors access to a metaverse basketball experience and chances to win All-Star game tickets. The project also intended to provide a scholarship at the University of Kentucky, Fox’s alma mater.

On February 23, SwipaTheFox's social media accounts were deleted and its Discord was mostly disabled. De'Aaron Fox canceled SwipaTheFox officially by tweet on February 24, 2022.

I want to address an NFT project we launched recently. The project launch was ill timed. I delegated certain aspects to the launch of the NFT in an attempt to partner with professionals. We weren’t happy with the execution & demand on my time and attention during the NBA season.

- De'Aaron Fox

Some of SwipaTheFox's investors were not happy. Investor @mediolanum_base called Fox's project shutdown a rug pull. Others felt that their investment would be safer in a project backed by a famous athlete. De'Aaron Fox is in the first year of a five-year, $163M contract with the National Basketball Association's Sacramento Kings. Their reasoning was simple: why would someone with so much money rug pull a project for just $1.5M?

Although Fox hinted at continuing to develop the SwipaTheFox project after the NBA season, the project's social media is inactive. According to Twitter user @BigBallerCrypto, Fox has offered some SwipaTheFox investors autographed jerseys as consolation for the project's early shutdown.

Investors will not be able to recover their money, because NFTs are not regulated like the stock market. Unfortunately, it also appears that the scholarship at the University of Kentucky will not be available.

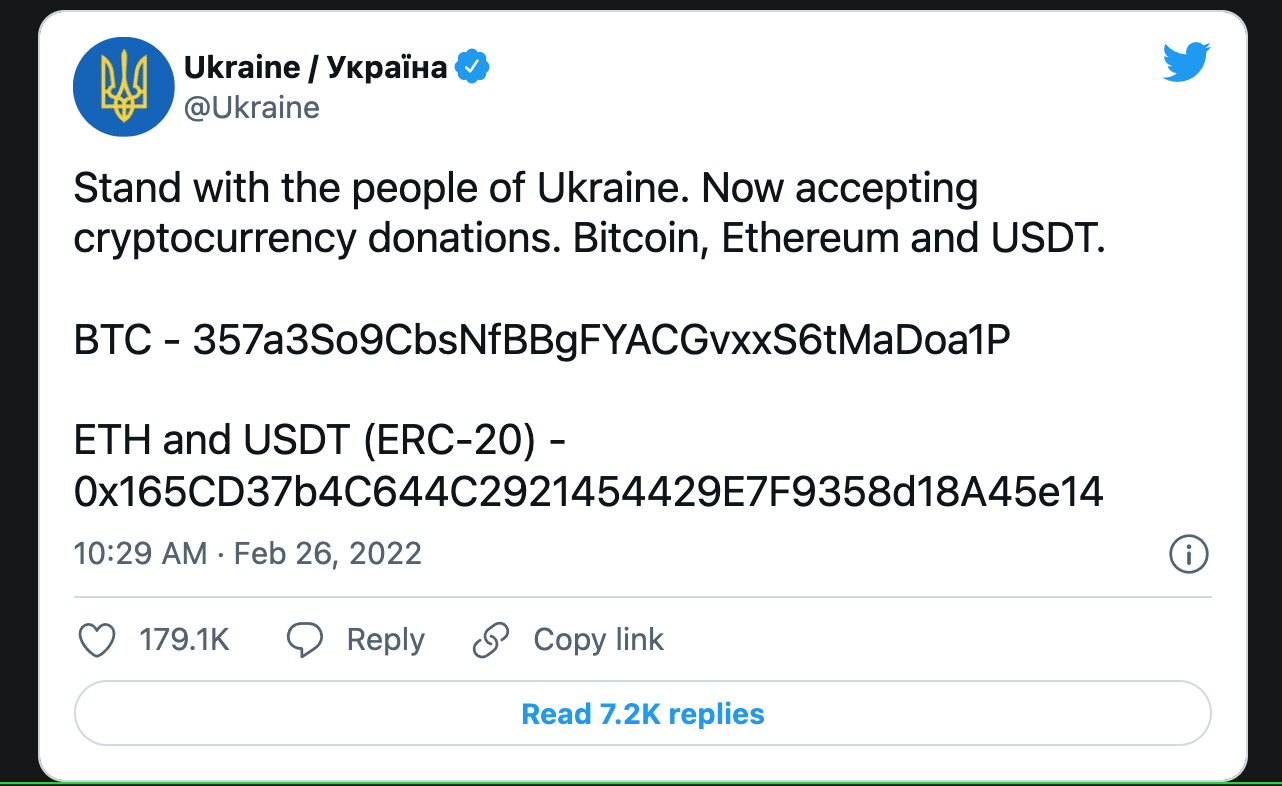

Ukraine Raises $18M in 24 hours with Crypto

At this point, we’ve all seen the memes from the Ukrainian government’s twitter account, but what we haven’t seen before is a government leveraging social media and cryptocurrencies to actively assist in a conflict. There has been large-scale sharing of information about Russian troop movements on Twitter, as well as crypto fundraising through Twitter.

Within 24 hours of the Ukrainian government tweeting out their Bitcoin, Ethereum, and USDT addresses, they saw roughly $14M worth of donations. Vatlik Buterin, founder of Ethereum, quickly jumped on this to warn that people should hold off for verification that this was not a hack. After speaking with a few officials, Vitalik confirmed that these addresses were controlled by the Ukrainian government. He also pointed individuals to another charity, ukrainedao.love, to help citizens suffering from the conflict. The charity has raised funds via an auction of an NFT, which is currently at over 1,100 ETH (~$3.8M). Vitalik, a Russian-born Canadian, has been outspoken against Putin’s actions.

Some well known crypto founders have also given money to the Ukrainian government. In particular, Gavin Wood, the founder of Polkadot, offered to give $5M in DOT and Justin Sun, the founder of TRON, made a $200k donation. In addition to these notable names, there has also been an anonymous donation of $3M BTC. As far as companies go, Binance announced an emergency relief fund which has raised $5.8M of the targeted $20M.

Earlier this month, both Russia and Ukraine legalized cryptocurrencies in what appears to be a savvy move for individuals to protect their money through volatile times.

How was today's email?