🍿 We're gonna need more Matt Damon

This week crypto.com was hacked and user funds were lost, Binance rolled out Eth L2 support, Feds are signaling regulatory clarity is coming, and is Walmart selling NFT deoderant?

Crypto.com Was Hacked

Crypto.com was hacked, and users' funds were stolen. The crypto exchange believes hackers bypassed the users' password and two-factor authentication (2FA), then withdrew assets from users' accounts. The Crypto.com dev team responded by freezing all crypto deposits and withdrawals across most of the company's product line until they fix the security issue.

It's unclear when Crypto.com was breached, but an influx of users began to complain of unauthorized withdrawals from their accounts last night. Crypto.com minimized the issue on Twitter:

"We have a small number of users reporting suspicious activity on their accounts. We will be pausing withdrawals shortly, as our team is investigating. All funds are safe."

Officially, only a small number of users were affected by the hack, but Reddit and Twitter exploded with users claiming their Bitcoin and Ethereum had been stolen.

According to Crypto.com, a fix is now being released worldwide. The exact timeline for the outage is unclear, but it seems like crypto deposits and withdrawals will have been disabled for 8 to 12 hours.

In order to withdraw funds, users will be required to reset their 2FA settings. Some users are reporting problems resetting their 2FA, and Crypto.com’s reset process may not operate well if every user needs to reset their 2FA at the same time.

Reddit user Grunblau claims to have received these instructions from Crypto.com for resetting 2FA:

To reset 2FA Authenticator, please contact our customer support and provide us with a short video of yourself saying the following:

Your name

Date of request

"2FA reset”Please make sure that your face and the upper part of your torso are clearly visible in the video. The size of the video has to be no larger than 40MB.

** Resetting your Authenticator settings will disable your 2FA protection on both your Exchange account and the Crypto.com App account.

Crypto.com customers may have their funds locked for a long time if their initial 2FA resets don't go well. The company has suggested that users’ stolen funds will be refunded, but they have not given a timeline.

Binance Announces Support for Ethereum Layer 2 Protocol Arbitrum One

After the absurd growth of Ethereum and many other Layer 1 projects last year, people coined this year as “Layer 2 2022,” and it would appear that title may indeed be accurate.

Binance, the largest crypto exchange in the world, just rolled out support for withdrawing directly to the Ethereum Layer 2 (L2) protocol Arbitrum One. L2 protocols solve a major problem for Ethereum: high gas fees. Right now, Ethereum gas fees seem like an annoyance, but just a couple of months ago we were looking at costs of $200+ to do any transaction on the blockchain. For Ethereum, the solution is to move your assets onto a Layer 2 protocol which consistently has lower fees and faster transactions.

Here’s the problem: up until now, moving from Ethereum mainnet to an L2 like Arbitrum involved paying the gas fee for an Ethereum transaction. There were no good ways to natively move assets into an L2 protocol. This means people who were new to crypto had a high financial barrier when testing out new projects.

While we are calling it Layer 2 2022, we already saw plenty of growth for Layer 2 protocols in the prior year. Exactly one year ago, the total value locked in L2 protocols was $120M; today that number has gone up to $5.68B. This expansion hasn’t been entirely without growing pains, however, as Arbitrum One recently had a prolonged outage.

So far, the only major exchanges that support direct withdrawals to L2s were crypto.com and KuCoin. Binance’s announcements suggest they had built out the code necessary to support direct withdrawals, but gave no indications of a release date prior to the withdrawal option debuting on the site. Coinbase recently announced they were integrating with Polygon, a competing L2 protocol.

Is the Fog of Federal Crypto Regulation Clearing?

For years, cryptocurrencies have been intermittently dragged down by the Fed and US Regulators running the groundhog day playbook with regulation. “Powell saw his shadow, another year of uncertainty.” Last year, we finally started to see politicians make moves to change this situation, and many major crypto figures like Sam Bankman-Fried (founder of FTX, Alameda Research) think this will be the year wherein we finally get some clear guidance from the government.

There are already a few signs of this becoming a reality. On Tuesday, Federal Reserve Chairman Jerome Powell went before the Senate for his confirmation hearing for his second term in the role. During this interaction, Powell confirmed that an official report on digital currencies would be coming in the next few weeks, and reversed his stance on stablecoins. Previously, Powell had stated that stablecoins would be made obsolete by the creation of a Central Bank Digital Currency (CBDC), essentially a stablecoin backed and controlled by the Fed. In this hearing, he said that CBDC’s and stablecoins could co-exist, giving much needed reassurance to the crypto markets and subsequently spurring a rally after weeks of depressed asset prices.

At the same time, there is pushback against the creation of a CBDC altogether. On Wednesday, US House Representative Tom Emmer introduced legislation banning the Fed from issuing a CBDC directly to consumers, stating that the surveillance capabilities of a CBDC infringes too greatly on individual privacy, and effectively puts the Fed in a position to compete with retail banks.

This turmoil is simultaneously set against the backdrop of significant inflation rates within the US, as well as the Fed attempting to decrease their involvement in stabilizing the market. A recent report for December put the yearly inflation rate at 7%, the highest since 1982.

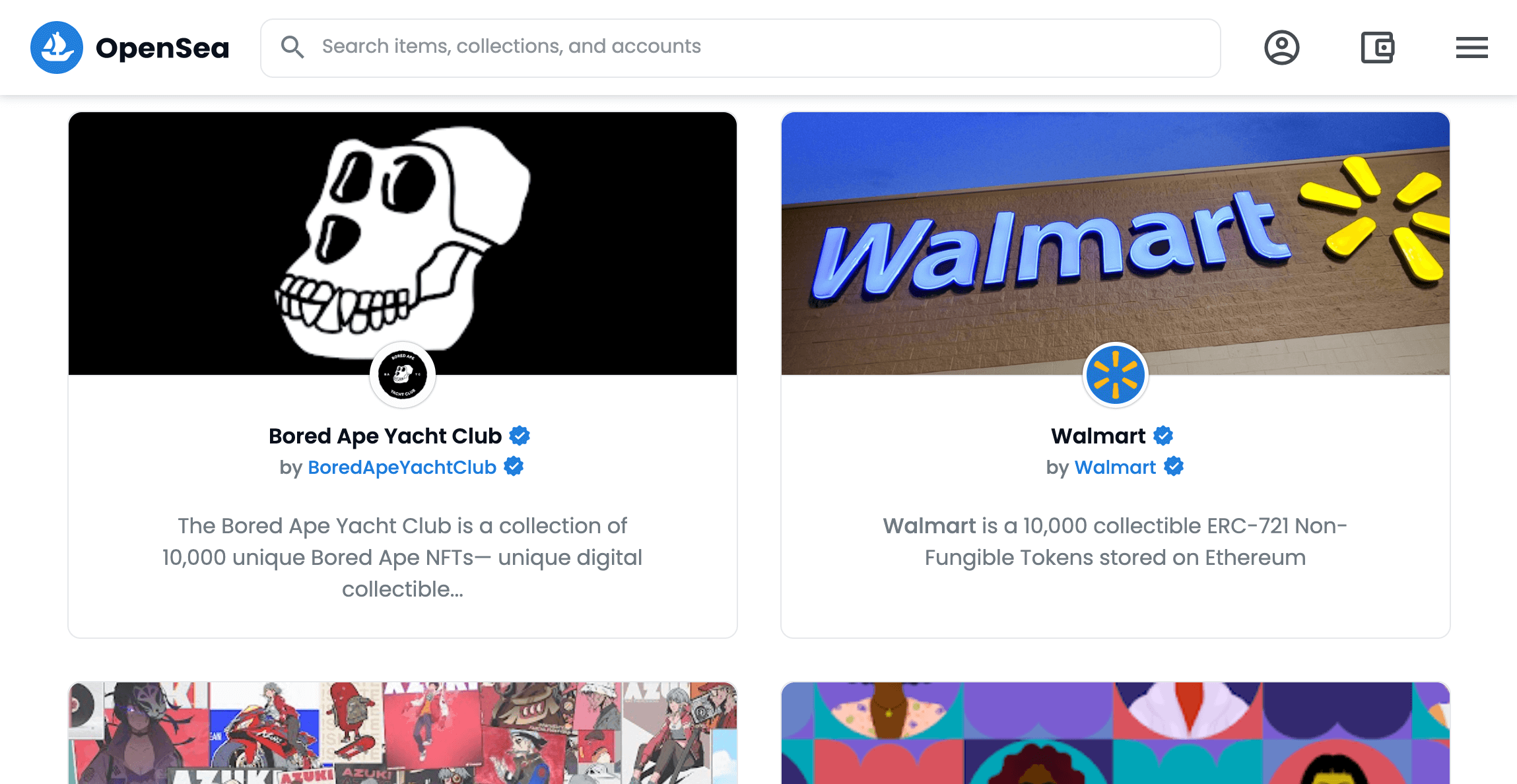

Walmart is Planning Its Own Metaverse, NFTs, and Token

Walmart is getting into crypto. Walmart intends to build its own metaverse, mint NFTs, and issue its own transaction token. According to the US Patent and Trademark Office, Walmart's attorneys filed seven separate applications regarding crypto and metaverse on December 30, 2021.

The company also intends to trademark virtual goods, including:

- personal care products

- electronics

- appliances

- apparel

- home goods

- toys

Some of these intended trademarks make sense within the context of Walmart's current business. It's easy to imagine Walmart selling a Taylor Swift digital t-shirt NFT to a kid whose avatar is running to virtual Walmart to get cigarettes for her mom.

But what are personal care products for in a metaverse?

It's unclear if Walmart intends to use an existing crypto project or build its own. Following the Litecoin pump-and-dump scheme that used a fake Walmart partnership announcement, it will be hard to know for sure without an official Walmart announcement.

Walmart has not given an official statement regarding its crypto future, but in an interview with Business Insider, a Walmart official said, "We don't have anything further to share today, but it's worth noting we routinely file trademark applications as part of the innovation process."

Quick Hits

Harmony (ONE) Network Outage

The EVM-compatible network went down last week due to heavy “spam traffic” on the network. Harmony’s fix appears to be higher gas fees.

Coin By News

PayPal is “Exploring” Its Own Stablecoin

The online payment processor confirmed to Bloomberg that it may create its own stablecoin.

ALGO’s First GameFi Platform Launches

Zone, a UAE-based startup, raised $2.3M and launched via an initial DEX offering last week.

USDC Passes USDT

For the first time, USDC has more liquidity on Ethereum than USDT. However, Tether remains the largest stablecoin across all blockchains combined.

Share This Morning on Chain

I know you like keeping us as your secret edge, but it'd help us a lot if you spread the newsletter. Help us grow 🌱