🎪 Wonderland: DAO It All Went Down

This week: Hackers stole $322M from Wormhole Bridge, we dig into El Salvadors "whale" status, big organizations are doing NFT tickets, and we do a full breakdown of the TIME Wonderland saga.

Hackers Take Wormhole Bridge for $322M

Hackers hit the popular blockchain bridge Wormhole yesterday, and they made off with the second largest bag of hacked DeFi cash ever. Wormhole is a bridge, which lets you transfer cryptocurrencies between blockchains—in this case, between Ethereum (ETH) and Solana (SOL). Wormhole uses Ethereum smart contracts to lock up Ethereum and mint wrapped Ethereum in the desired crypto ecosystem. This hack was done in the Solana ecosystem, minting wrapped Ethereum (wETH) on Solana.

The hacker minted 120,000 wETH on Solana, and redeemed 93,750 wETH for ETH on Ethereum’s network. In the Solana ecosystem, the hacker swapped their wETH for $44m in SOL and USDC.

With all of this real ETH disappearing from Wormhole, there are concerns about the company’s ability to back the remaining wETH in circulation. In response, Wormhole tweeted, “ETH will be added over the next few hours to ensure wETH is backed 1:1. More details to come shortly.” There is no update on where the $322M is going to come from, as Wormhole only had $1B in TVL before the hack.

Some of the hacked ETH was invested in unusual projects: SportX (SX), a gambling site; Meta Capital (MCAP), a NFT and Metaverse investment DAO; and Bored Ape Yacht Club Token (APE). In terms of crypto projects, these are all very small cap projects, mostly only a few million.

Wormhole has similar integrations with 7 other projects, such as Terra (LUNA). There have been no other reports of exploits being abused there, and the Wormhole team has frozen the project and patched the bug.

Wormhole has since offered the hackers $10M to return the funds, a gambit which has been successful in previous hacks.

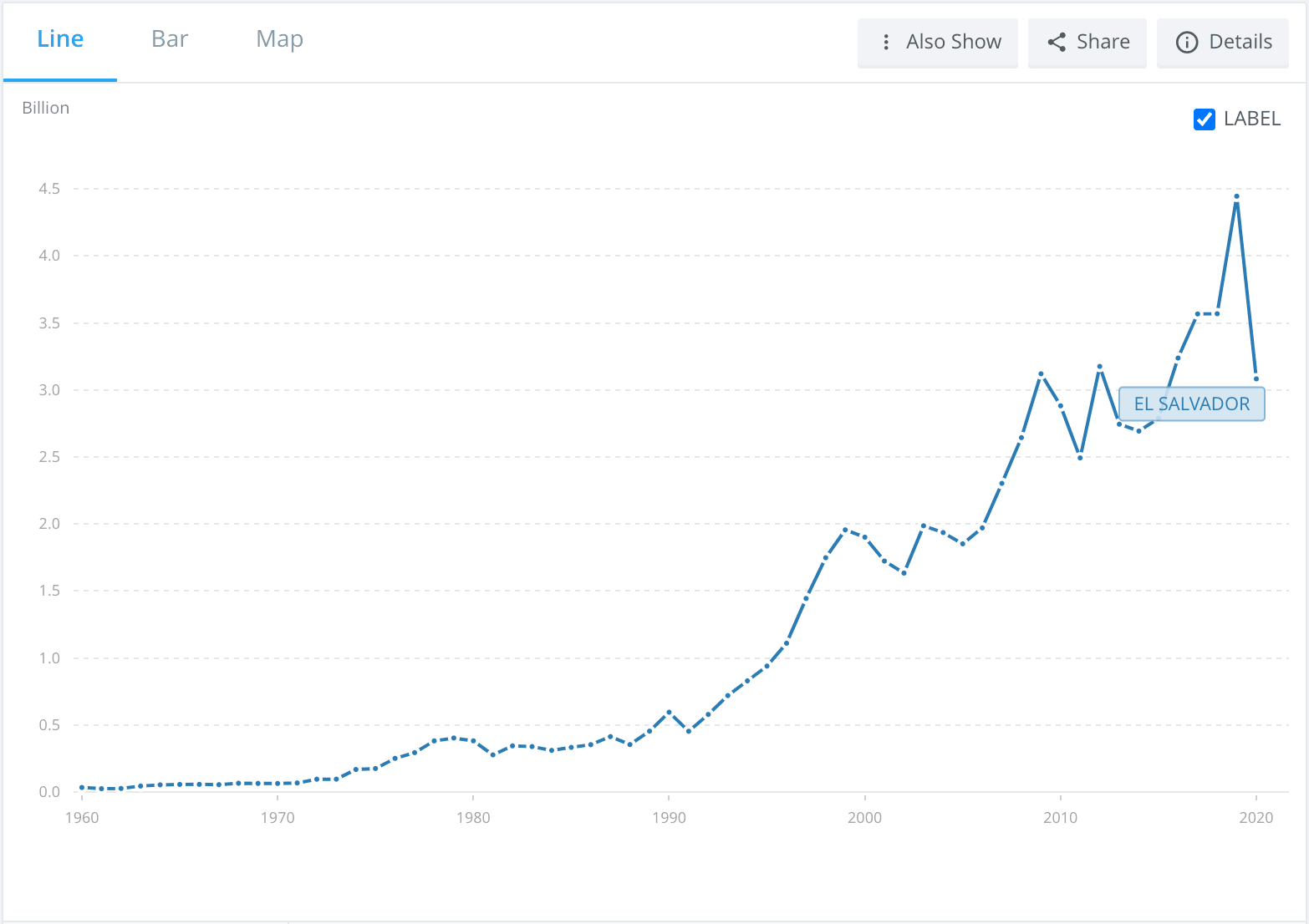

How Much Bitcoin Does El Salvador Really Have?

El Salvador holds $70M in Bitcoin. President Nayib Bukele is a famous Bitcoin bull, but El Salvador's Bitcoin holdings only account for 2% of the nation's $3B reserves.

El Salvador, a Central American country with a 6.5 million population, adopted Bitcoin as legal tender last summer. Since his nation adopted Bitcoin, Bukele has publicly announced each of El Salvador's Bitcoin purchases on Twitter. El Salvador has also introduced low taxes on crypto income that are intended to attract outside investors.

El Salvador applied for a $1.3B loan from the International Monetary Fund (IMF) early last year, then adopted Bitcoin as legal tender a few months later. While reviewing the case, the IMF recommended El Salvador drop Bitcoin's use as tender. El Salvador refused.

While allowing Bitcoin's use as legal tender may be risky, holding 2% of a small nation's treasury in Bitcoin does not seem to be extremely risky behavior. According to the World Bank, El Salvador is believed to have $3B total in its reserves, including gold. Bukele revealed that his country holds about 44,000 ounces of gold worth $79M. So El Salvador holds more gold than Bitcoin, and it only holds about 1,700 BTC. El Salvador is far from all-in on Bitcoin, and according to data from Bitcoin Treasuries, the small nation is far from being a Bitcoin whale.

China and Russia are believed to hold significant amounts of Bitcoin, but it's difficult to know how much. Below are more closely verified Bitcoin holdings by funds, companies, and nations.

| Entity | BTC Holdings | % of BTC | USD Value |

|---|---|---|---|

| Greyscale | 655k | 3.12% | $27.19B |

| Block.one | 164k | .78% | $6.81B |

| MTGOX K.K. | 142k | .68% | $5.88B |

| MicroStrategy | 125k | .60% | $5.19B |

| CoinShares | 70k | .33% | $2.89B |

| Ukraine | 46k | .22% | $1.92B |

| Tesla | 43k | .21% | $1.79B |

| Marathon | 8k | .04% | $340M |

| Square | 8k | .04% | $330M |

| Coinbase | 4k | .02% | $187M |

| 🐬 El Salvador | 1.7k | .003% | $70M |

NTF Tickets: NFT Super Bowl Tickets, Coachellas Lifetime NFT Tickets

It’s not news to anyone that NFTs are becoming more mainstream, but now their function is beginning to expand beyond the mere trade of expensive .jpegs; namely, to include event ticketing. The NFL recently announced that they are giving out customized NFT tickets to people attending Super Bowl LVI. They have also partnered with Ticketmaster to launch a series of “historic commemorative” NFTs and plan to mint NFTs celebrating the winner of the game.

The NFL experimented with “virtual commemorative ticket NFTs” earlier in the season, and according to the league, they “witnessed great success.”

The NFL isn’t the only one experimenting with NFT ticketing. Coachella, one of the largest music festivals in the US, announced this week that they were auctioning off NFTs that come with lifetime festival passes and “access to Coachella-produced virtual experiences forever.” They’re planning to auction off 10 of these NFTs, called the ‘Coachella Keys Collection.’

To launch this project, Coachella “partnered with FTX US to build an environmentally friendly marketplace on Solana.” Recently, FTX launched an NFT marketplace, and has raised money to build that marketplace out.

At the time of writing this article, the most recent bid on the Coachella Key Collection NFT is $55,000.

TIME Wonderland Survived a Rug Pull and a Corporate Raid, But is It a Scam?

The Beginning of TIME

Daniele Sestagalli is the public face of Frog Nation, a crypto group associated with several popular projects, including Wonderland, lending protocol Abracadabra, and yield optimization platform Popsicle Finance. Sestagalli ran Wonderland with a CFO known only as “Sifu.”

Wonderland (TIME) is a fork of OlympusDAO (OHM) on the Avalanche network. In Q3 2021, the project exploded in popularity due to its high APY and rich leveraging ecosystem. On January 15, 2022, Wonderland had almost $2.6B in total value locked (TVL). Just three weeks later, Wonderland’s TVL is around $900M.

OlympusDAO and Its Forks' 15 Minutes of Fame

OlympusDAO exploded in popularity in late Q3 2021, bringing investors into the DAO by offering an 8,000% APY. At its peak, OlympusDAO reached a $4B market cap. Today, it’s worth $113M. The project attracted dozens of copycats, with several reaching extremely high valuations within months of launching.

How Wonderland Works

Wonderland famously averaged an 80,000% APY, paid in TIME tokens. The idea is that investors buy TIME tokens, which Wonderland mints. Wonderland then uses the investors’ funds to buy treasury assets. TIME's value is expected to fall over time, and the project's economics rely on a steady stream of new investors entering the ecosystem to keep TIME’s price from crashing.

Investors were wary of the projects' claims of high APY, but Wonderland's leadership promised to stabilize the token's price with TIME buybacks funded from the Wonderland treasury. Many Wonderland investors took this as evidence of a "price floor," and leveraged their assets accordingly.

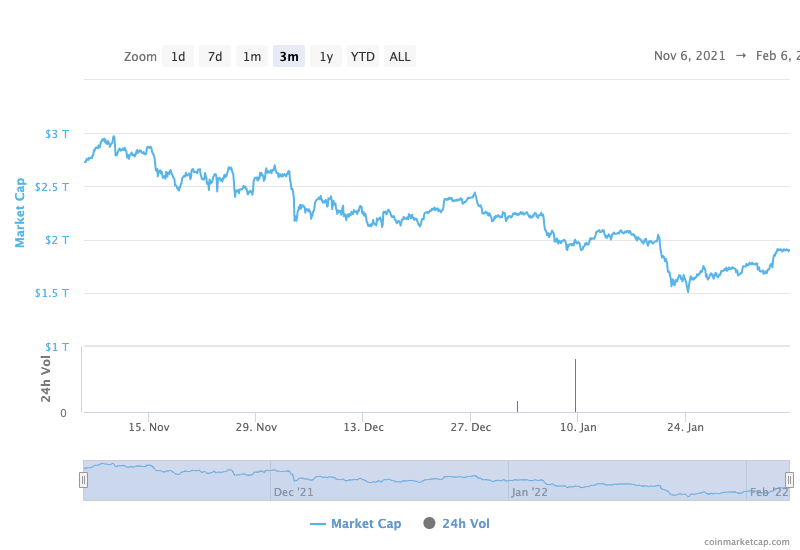

Market Shifts

The crypto market has trended down over the last few months, worth roughly $1.9T today, down from $2.7T just 90 days ago.

Although this sort of downturn is a fairly typical downturn for the crypto market, OlympusDAO and its forks did not survive. Investors in these projects expected massive gains--often using leverage to achieve their desired returns. As the market trended sideways and down, leveraged positions were liquidated and investors lost confidence in high-APY DAOs.

OlympusDAO and Its Forks

| Name | Token | Avg. APY* | ATH Price | Current | Down Since ATH |

|---|---|---|---|---|---|

| OlympusDAO | OHM | 8,000% | $1,415 | $62 | -96% |

| Wonderland | TIME | 80,000% | $10,063 | $281 | -97% |

| Hector DAO | HEC | 400,000% | $357 | $22 | -94% |

| Klima DAO | KLIMA | 35,000% | $ 3,777 | $47 | -99% |

| Euphoria | WAGMI | 600,000% | $1,892 | $27 | -99% |

| OtterClam | CLAM | 150,000% | $69.12 | $4 | -93% |

| MetaversePro | META | 80,000% | $410 | $17 | -95% |

| R U Generous | RUG | >1,000,000,000% | $2,041 | $4.19 | -99% |

| Rome | ROME | 150,000% | $1,679 | $74 | -96% |

| Spartacus | SPA | 320,000% | $323 | $15 | -95% |

| Jade Protocol | JADE | 3,000,000% | $876 | $ 21.68 | -98% |

| Nidhi Dao | GURU | >1,000,000,000% | $393 | $2.02 | -99% |

| Fortress | FORT | 1,200,000% | $215 | $6 | -97% |

| OneDao Finance | ODAO | >1,000,000,000% | $11,108 | $35.30 | -99% |

| Snowbank | SB | 1,000,000% | $6,154 | $194 | -97% |

| Exodia | EXOD | 200,000% | $13,669 | $120 | -99% |

| Nemesis DAO | NMS | 20,000,000% | $6,366 | $55.66 | -99% |

*Average APY during maximum traction & investment (sources: coingolive, livecoinwatch).

Is Wonderland a "Soft" Rug Pull?

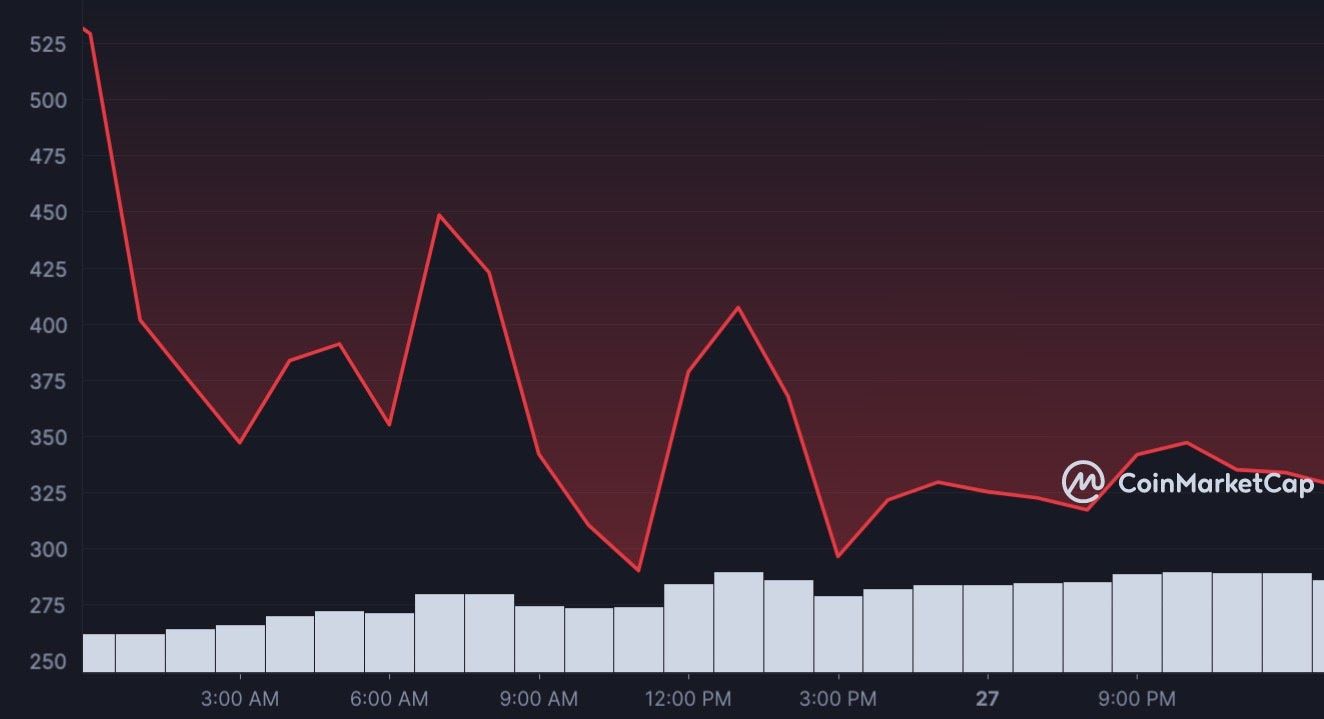

90-Day TIME to USD chart showing TIME’s fall to around $400 from $9,511. Source: CoinMarketCap

As the TIME token dropped in value over the last few months, Wonderland's leadership encouraged investors to stick with the project. Sifu implied the team was investing treasury money in projects intended to generate long-term revenue, such as Betswap (BSGG), an online gambling platform. As Wonderland lost investors, it promised to airdrop BSGG tokens to loyal TIME holders. This airdrop has not happened.

Wonderland leadership had promised to buy back TIME tokens at certain price points to ensure the token wouldn't flash crash. As TIME rapidly lost value during January, it passed each buyback price point with no buybacks from the Wonderland team. Finally, when TIME was worth only $1,000–down from a high of $9,700–Sifu initiated buybacks that stabilized the price near $1,000 for a couple days. Within a week, a massive selloff by a small group of whales dropped TIME to $400 from $800.

This flash crash liquidated many investors' positions on Abracadabra, a DeFi lending platform popular with Frog Nation. Abracadabra offered leveraged yield farming products that paired TIME, MIM, and UST, a Terra ecosystem stablecoin. According to a Reddit user who appears to strongly dislike DAOs, Sestagalli and Sifu claimed they didn't stop the flash crash with a buyback because they were sleeping. Every position that was liquidated left assets behind in the Wonderland treasury.

Some investors suspect the Wonderland leadership let the TIME token tank, liquidating leveraged positions in the process. Wonderland could gain control over additional treasury assets by liquidating investors on Abracadabra, since Wonderland keeps the treasury assets.

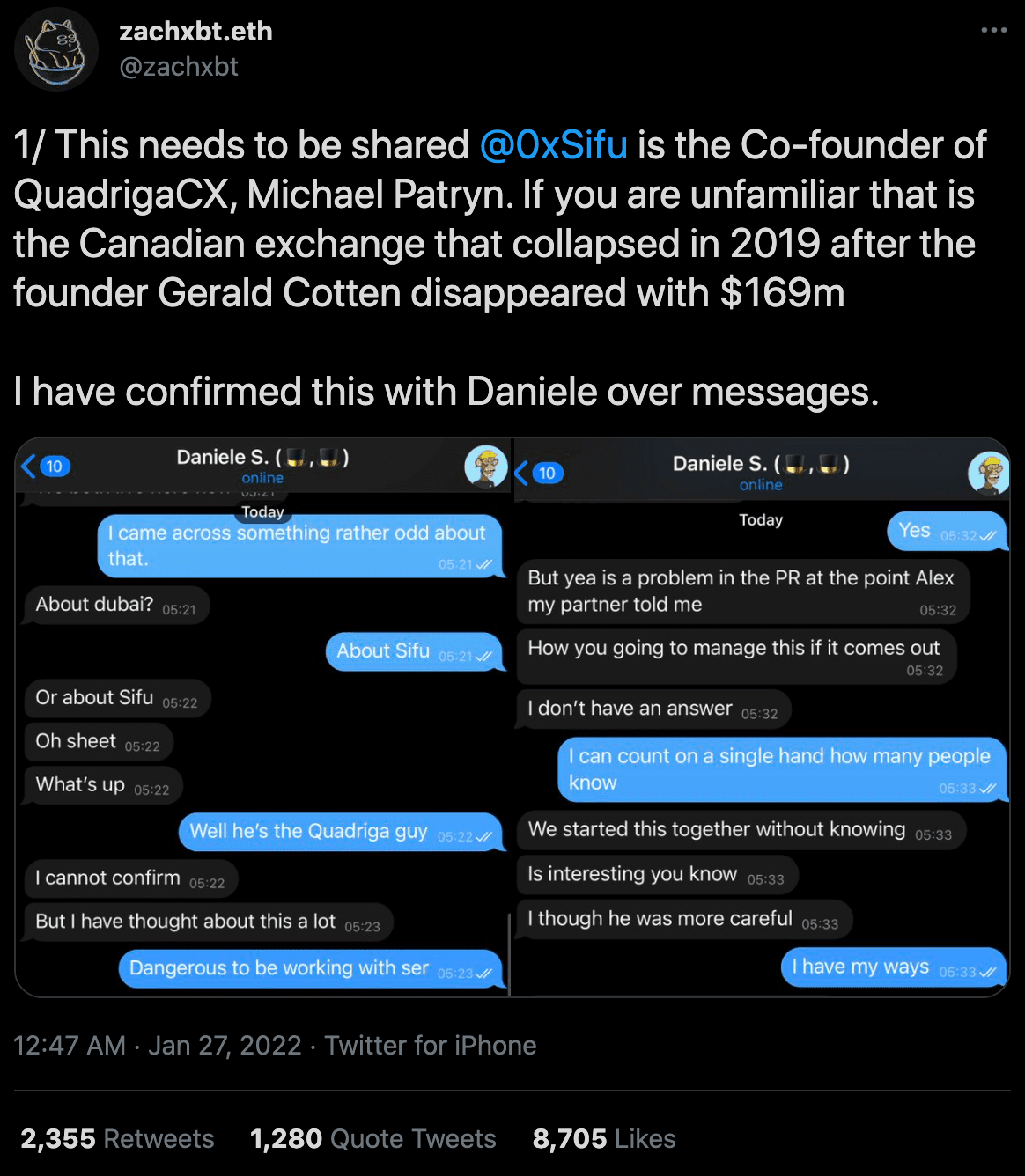

One day later, news broke that famed exit scammer Michael Patryn may be Sifu, Wonderland's CFO and treasury manager.

Wonderland's CFO Suspected to be Exit Scammer Michael Patyn

On January 27, Twitter user @zaxhxbt revealed Sifu's identity and shared a chat with Daniele Sestagalli confirming Sifu's identity as Michael Patryn. Patryn is suspected of stealing over $150M in an exit scam at Canadian centralized exchange QuadrigaCX, in 2019. Previously, Patryn had served prison time in the US for identity fraud.

Wonderland's TIME token had already fallen 90% in a few months, and rumors of an exit scammer in charge of the project's multi-billion dollar treasury did not improve investor confidence. TIME fell 40% in a day, to $325 from a starting point of $525.

Immediate Aftermath of the Sifu Doxx

The Sifu doxx crashed more than just TIME. The Terra (LUNA) and Frog Nation ecosystems were thrown into turmoil.

On Abracadabra, investors were using "fake" Magic Internet Money (MIM) that was minted with leverage to create Terra's UST token, which subsequently burned LUNA, and which then increased the price of the LUNA token. As investors unwound their MIM positions to get out of TIME and Abracadabra, UST began to lose its peg to the US Dollar. When this discrepancy arises, Terra prints LUNA tokens in an effort to stabilize UST back at $1, but the LUNA token's price decreases as a result.

Wonderland Narrowly Survives a Corporate Raid

Some investors believe Sestagalli allowed TIME to crash because it created an arbitrage opportunity for TIME whales. If Wonderland were to shut down, all of the project's treasury would be distributed to TIME token holders. Wonderland’s treasury assets were valued higher than the TIME token’s market cap. This would allow anyone buying TIME tokens at the end of January to immediately profit if Wonderland shut down. The same shutdown would also put most Wonderland investors deep in the red.

On January 29, Wonderland took a vote. TIME token holders could vote on whether to shut down Wonderland and distribute its treasury to TIME holders, or to continue the project. As expected, most TIME holders wanted to continue the project, while a small number of whales wanted to end Wonderland and take their portion of its treasury.

At the end of the vote, 55% of TIME tokens had voted to continue the project, while closer to 70% of the TIME wallets voted in favor of continuing. Several of the whales who voted to shut down the project used new wallets, suggesting they bought TIME specifically to vote to shut Wonderland down and turn a quick profit.

Sestagalli Kills Wonderland Anyway

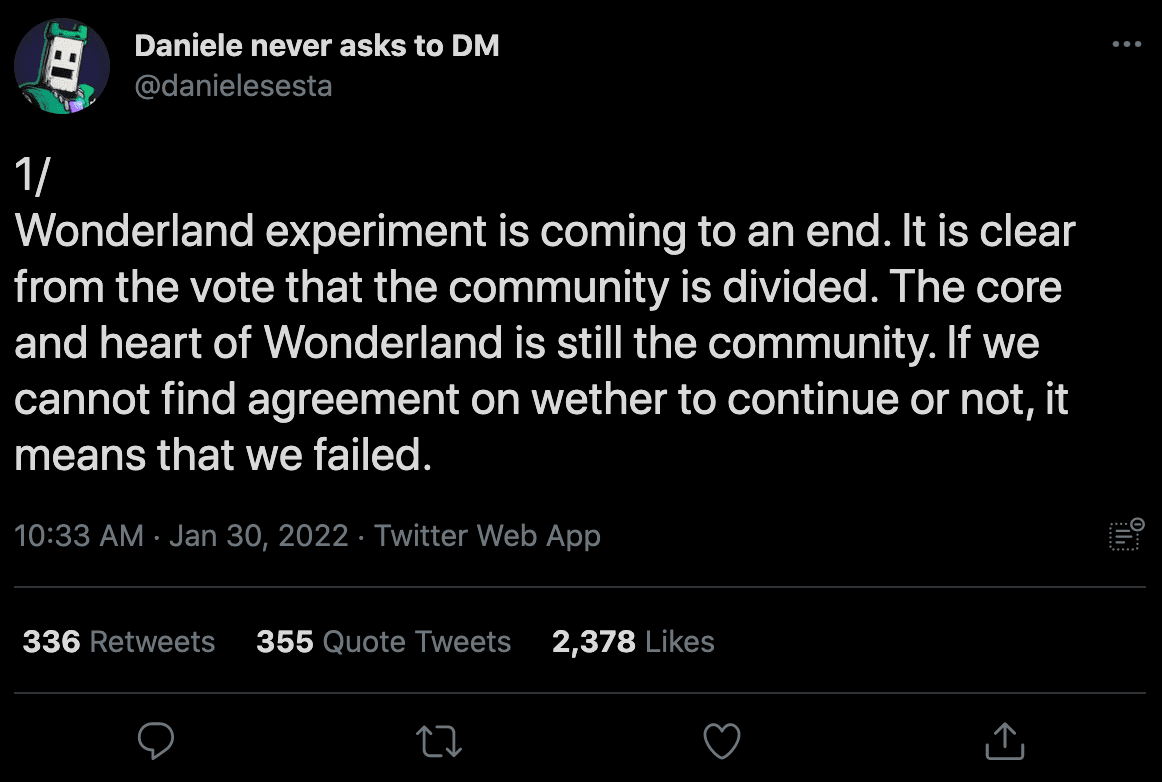

Despite TIME token holders voting in favor of continuing the project, Sestagalli announced on Twitter that he would shut down Wonderland.

It's possible that Sestagalli would benefit more from an immediate Wonderland shutdown than he would from continuing to run the project. It's also possible that Sestagalli was feeling stressed out by the Wonderland collapse. On January 27, days before Wonderland's collapse, Sestagalli claims he was already receiving a high volume of death threats. No DAO is worth dying over--especially this one.

Wonderland was Only Mostly Dead

Sestagalli surfaced a few days later for an AMA in which he addressed Wonderland's future. Sestagalli said the project will not end, and he addressed the need for a new leadership structure, new tokenomics, and mentioned he intended to reimburse some of the Wonderland investors who were liquidated.

According to Sestagalli, Sifu will no longer be associated with Wonderland. His replacement will be publicly known, as will all other personnel in charge of Wonderland's treasury. Sestagalli says that TIME holders will receive BSGG tokens through an airdrop, but did not mention when or how much each investor would receive. Finally, Sestagalli teased two potential new directions for the project, "Wonderland 2.0," and the "Professor Proposal." Whether these changes will save Wonderland remains to be seen.